Summary:

- Cebu Pacific has revised downwards its seat capacity growth projections for 2019 due to expected delays in A320neos and A321neos;

- The airline is still planning to resume capacity growth in 4Q2018 and 2019, ending a three-year period of virtually no growth, but rate will be less than expected;

- Cebu Pacific strategically needs to resume growth after losing market share to Philippines AirAsia and the Philippine Airlines Group over the last three years.

In releasing 2Q2018 results in Aug-2018, the Cebu Pacific Group (which includes turboprop subsidiary Cebgo) projected +18% seat capacity growth for 2019. In releasing 3Q2018 results earlier this week, the group stated that it now expects seat capacity growth in the "low teens" (roughly +13% to +14%).

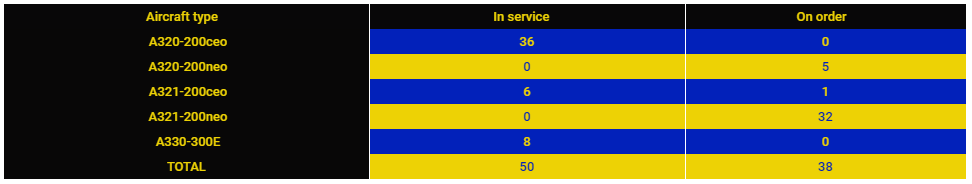

An exact figure is not being provided as there is uncertainty in the A320 delivery stream. However, Cebu Pacific executives are expecting persistent delays, which could impact all 13 A320neos/A321neos the airline is now slated to receive next year. While Cebu Pacific may still receive all 13 aircraft (eight A321neos and five A320neos) most could arrive a few months late, forcing Cebu Pacific to delay the implementation of planned capacity additions.

"Frankly we are very pi**ed off," Cebu Pacific CEO Advisor Mike Szucs told analysts during the group's 14-Nov-2018 3Q2018 results call. "We are extremely upset with both Airbus and Pratt & Whitney."

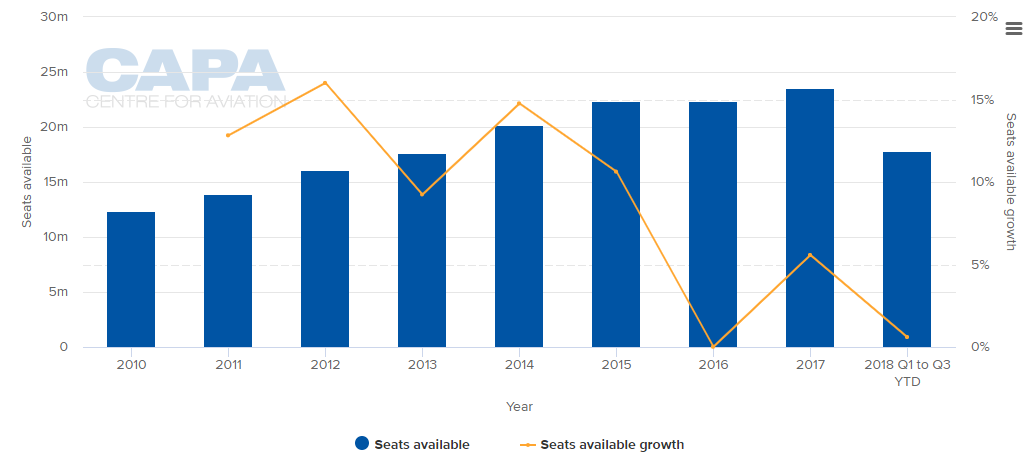

While +18% capacity growth seems overly ambitious given the current challenging market conditions, Cebu Pacific was keen to grow capacity in the high double digits next year to make up for three years of virtually no capacity growth.

CHART - Cebu Pacific Group's seat capacity nearly doubled from 2010 to 2015 but has since been relatively flat Source: CAPA - Centre for Aviation and company reports

Source: CAPA - Centre for Aviation and company reports

The hiatus in expansion was intentional as Cebu Pacific decided to wait for more efficient new generation aircraft. However, its two main competitors (Philippines AirAsia and the Philippine Airlines Group) have expanded rapidly during this period, leading to market share declines for Cebu Pacific. The Cebu Pacific Group's market share reached a high of 41% in 2015 (60% domestic market share and 20% international market share) but has slipped to around 34% this year (51% domestic and 18% international).

The group will still have significant growth in 2019 but executives were eager to achieve the initial +18% figure as it would have enabled it to "catch up" and recover market share.

The resumption of growth starts in the current quarter. Cebu Pacific projects +9% to +10% seat capacity growth in 4Q2018 compared to growth of less than +1% in the first three quarters. Capacity this quarter is up due to the delivery of six A321ceos in recent months. Cebu Pacific plans to take delivery of one more A321ceo (its last ceo) and its fist A321neo by the end of the year. Fleet expansion will further accelerate in 2019 with the 13 albeit delayed neo deliveries.

The projected capacity growth is driven partially by up-gauging, as A321s replace A320s at slot constrained Manila, freeing up A320s for expansion in secondary markets (mainly Cebu and Clark). Cebu Pacific also plans to return three A320s in 2019; its narrowbody fleet is therefore slated to expand by 10 aircraft in 2019 (from 44 to 54).

CHART - Alongside its short haul renewal, Cebu Pacific also operates A330s, but currently has no plans to expand its widebody fleet Source: CAPA- Centre for Aviation Fleet Database (as at 15-Nov-2018) NOTE: ATR turboprops are also flown by its regional subsidiary Cebgo

Source: CAPA- Centre for Aviation Fleet Database (as at 15-Nov-2018) NOTE: ATR turboprops are also flown by its regional subsidiary Cebgo

Delays in A321neo deliveries mean Cebu Pacific has had to postpone up-gauging flights at Manila, a generally lucrative market with demand exceeding supply due to the infrastructure constraints. It has also resulted in delays in moving A320s to secondary bases - where all the market share declines have taken place. Expansion at Cebu and Clark may not be profitable given that these markets are lower yielding than Manila and have become very competitive, but is strategically important.