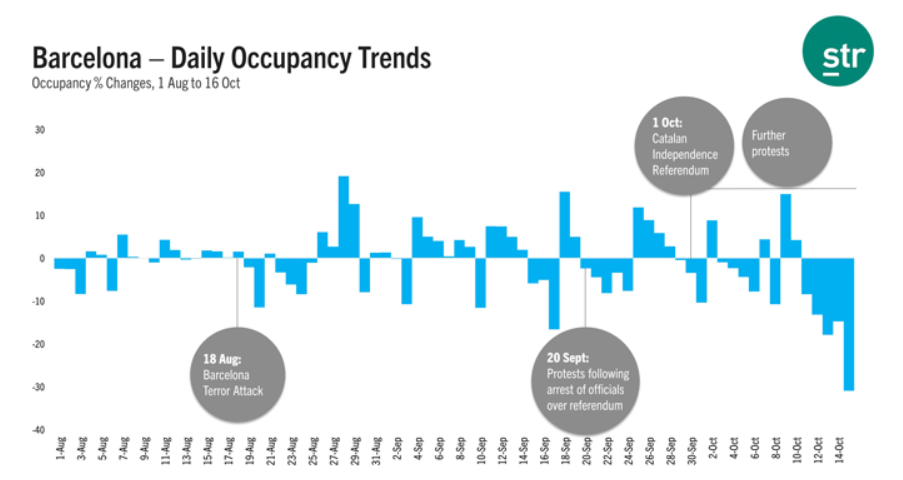

Prior to October, the market's hotel performance was strong despite the 18-Aug-2017 terror attack and ongoing protests leading up to the referendum. In fact, Barcelona posted its highest ever RevPAR level for both the month of August (EUR146.11) and September (EUR140.75), experiencing double-digit increases compared with the same two months in 2016.

CHART - Analysis from STR shows revenue per available room (RevPAR) in Barcelona dropped considerably during the first five days after the Catalan independence referendum, with the sharpest year-over-year decline (-27.5%) on 4-Oct-2017 Source: STR

Source: STR

Insight from STR shows occupancy levels in the city dropped for six of the seven days after the 18 Aug-2017 attack, but quickly recovered beginning on 26-Aug-2017. STR analysts noted that August hotel performance was lifted substantially by the ESC Congress (26-30 August), the world's largest cardiovascular congress, which typically hosts around 30,000 attendees.

The Sants-Montjuic submarket, which houses many hotels near the host exhibition centre, posted a 17.6% increase in average daily rates (ADR) during the 1-Aug-2017 to 16-Oct-2017 period, and was the only submarket in Barcelona to record an increase in occupancy (+0.4%) for that date range.

"Hotels in the market have been experiencing cancellations from the Group segment (bookings of 10 or more at once) since the beginning of October," says Javier Serrano, STR's market manager for Spain and Portugal. "Barcelona's performance has slowed down since the political unrest commenced."

This will likely be the new trend for the remainder of the year and will have a directly negative impact on occupancy levels and will probably also affect ADR levels in the following months. "As we enter 2018, the market will also face a high basis of comparison with this year, which has seen 15.1% RevPAR growth through September," warns STR.

Elsewhere, data specialists ForwardKeys, which help forecast future travel by analysing around 17 million flight booking transactions a day, says its own analysis shows international air reservations for Catalonia have fallen 22% since the beginning of October (up to 25-Oct-2017), benchmarked against the equivalent dates last year. As the company's CEO, Oliver Jager notes, this will have a knock-on effect beyond Catalonia and across Spain as a whole as many visitors arriving in Catalonia will travel across Spain.

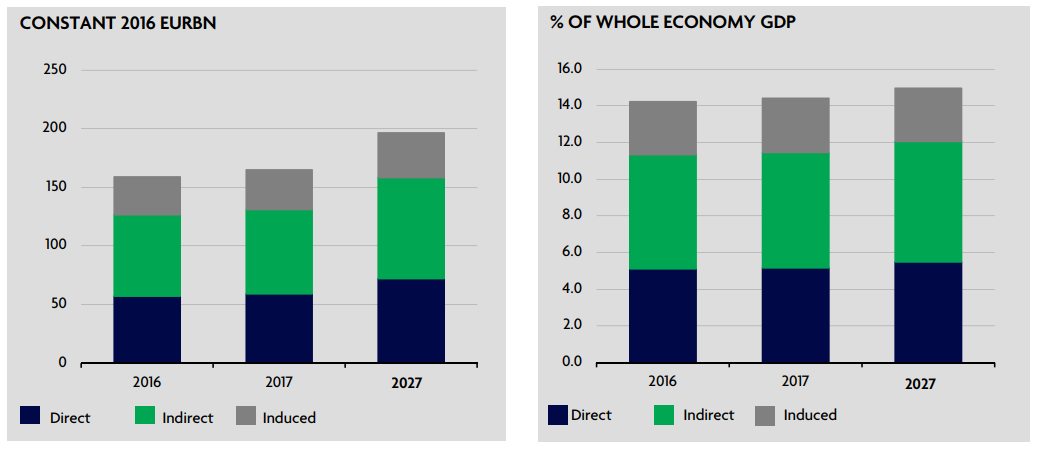

Together these figures paint a picture of clear concern as domestic political unrest almost always deters visitors and ongoing issues will likely lead to a further decline in bookings. This trend is of great concern as the travel and tourism sectors represent a large proportion of the Spanish economy, over 14% of GDP. According to World Travel & Tourism Council (WTTC) data the total contribution of travel and tourism to GDP was EUR158.9 billion (USD177.2 billion), 14.2% of GDP in 2016, and was forecast to rise by 3.8% in 2017, and to rise by 1.8% per annum to EUR196.5 billion (USD219.2 billion), 15.0% of GDP in 2027.

CHART - The total contribution of Travel & Tourism to Spain's GDP (including wider effects from investment, the supply chain and induced income impacts) was EUR158.9 billion and is expected to grow 3.8% to EUR164.9 billion (14.4% of GDP) in 2017 Source: Worlds Travel & Tourism Council (WTTC)

Source: Worlds Travel & Tourism Council (WTTC)