Summary:

- An analysis from The Blue Swan Daily highlights how the aviation sector in Puerto Rico, St Maarten, the US Virgin Islands and Cuba have been hit hard following last year's violent storms in the Caribbean;

- Overall, scheduled air seats within and from the Caribbean declined by -6.4% during the first half of this year, according to the report;

- More than 1.6 million departure seats were removed from the Caribbean aviation system during the first half of 2018, versus the same period the previous year;

- Aviation is essential to supporting tourism in the Caribbean region, transporting approximately 50% of all tourists who travel there, supporting over 1.6 million jobs and more than USD35.9 billion in GDP, equivalent to 14% of the total Caribbean economy.

After two major hurricanes tore through the Caribbean in less than two weeks in Sep-2017 some of the most idyllic - and tourism-dependent - destinations were left devastated. While it is not uncommon for this area of the world to suffer from weather events, Hurricanes Maria and Irma were among the most powerful Atlantic basin storms ever recorded and brought catastrophic flooding, destroyed homes and infrastructure, and left people without power, clean water and essential services, killing more than 35 people in the process.

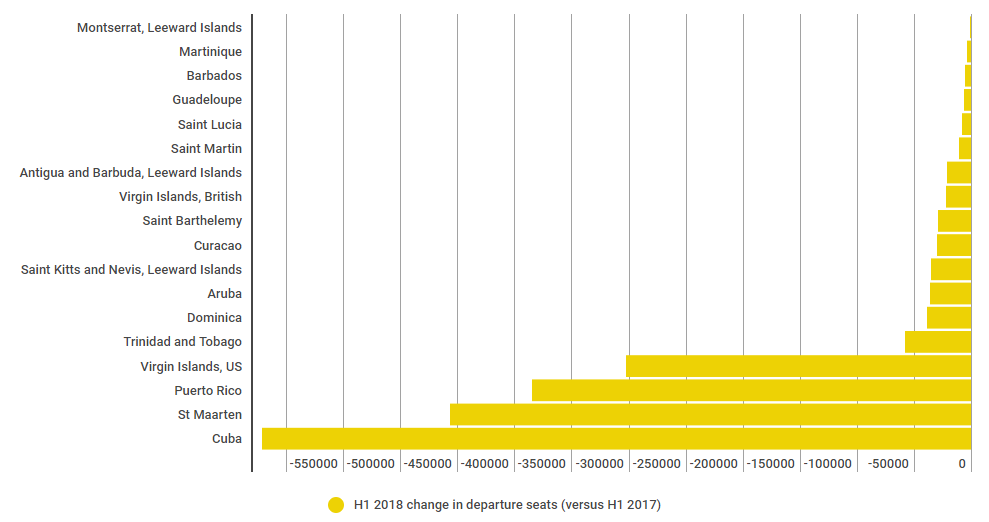

Overall more than 1.6 million departure seats were removed from the Caribbean aviation system during the first half of 2018, versus the same period the previous year, down from 25.2 million in H1 2017 to 23.6 million this year. The largest declines were seen in the markets hit the hardest by last year's storms: Cuba (-621,309), St Maarten (-456,504), Puerto Rico (-384,547), US Virgin islands (-302,365).

CHART - More than 1.6 million departure seats have been taken out of the Caribbean market over the first half of 2018, mainly as an impact of last year's horrific storms that battered the region Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

These were among 18 Caribbean nations to see a reduction in year-on-year departure capacity in H1 2108, according to schedule data from OAG. But, our analysis also highlights some key growing markets across the region, most notably Dominican Republic, Haiti and Jamaica that have all added more than 100,000 departure seats over the six month period, versus last year. Double-digit growth in H1 departure capacity was also recorded by St Vincent and the Grenadines (+27.3%); Grenada, Windward Islands (+12.0%); and Bonaire, Saint Eustatius and Saba (+11.8%); but all from a much lower reporting base.

Aviation is essential to supporting tourism in the Caribbean region, transporting approximately 50% of all tourists who travel there. IATA says aviation in the region supports over 1.6 million jobs and more than USD35.9 billion in GDP, equivalent to 14% of the total Caribbean economy, but the belief is it could achieve much more if governments work with industry to maximise the value aviation delivers.

"Unfortunately, too many of the region's governments still see air travel primarily as a luxury for the wealthy -- and an easy target for taxation. Making matters worse, these taxes and fees usually are not spent on boosting the efficiency and capacity of the airport and airways infrastructure, but rather to put money into the treasury," explains Peter Cerda, IATA's regional vice president for the Americas.

The airline body's own analysis highlights that in one Caribbean state, roughly 70% of the average one-way fare is made up of taxes and charges and there are 10 other Caribbean markets for which taxes and charges represent more than 30% of the ticket price, according to the same report.

Air connectivity is a critical element for economic growth and development, especially for the small island nations of the Caribbean. Additional air services and frequencies mean higher traffic volumes, which in turn help to improve economic competitiveness and therefore create employment opportunities. Improved and more regular air connections enable economies to attract more tourists (including non-leisure visitors), conduct more trade and attract more foreign investment. Without these important air links, a country's economy and employment potential could suffer.

A new study from the Caribbean Development Bank, the 'Air Transport Competitiveness and Connectivity' report, proposes some realistic and practical policy actions to overcome the barriers to intra-regional air traffic and create conditions that will lead to better service and therefore enhanced economic activity and job creation. It says such measures would "help reverse the decline in intra-regional journeys, with positive implications for developing multi-destination tourism in the Caribbean".

Greater coordination across governments, with joined-up policy between transport, tourism and other economic ministries would further increase the chances of successful outcomes," it adds. Together these policy remedies could significantly increase GDP and employment across the Caribbean and in a best case scenario based on an expected 28% increase in passengers across the Caribbean could deliver an increase in regional GDP of nearly USD 3.3 billion by 2025, providing an extra 207,000 jobs.

MORE INFO? Read the full report: Air Transport Competitiveness and Connectivity