The latest findings, based on a survey fielded in late May-2020, tracks sentiment as the world struggles with the fallout from the covid-19 pandemic. An almost 12 point improvement in sentiment about the three-month outlook for the global economy brought the barometer reading to -27.7, up from -39.4 in the first edition, based on an Apr-2020 survey. A positive shift but still a long way from optimism (the barometer ranges from -50 to +50).

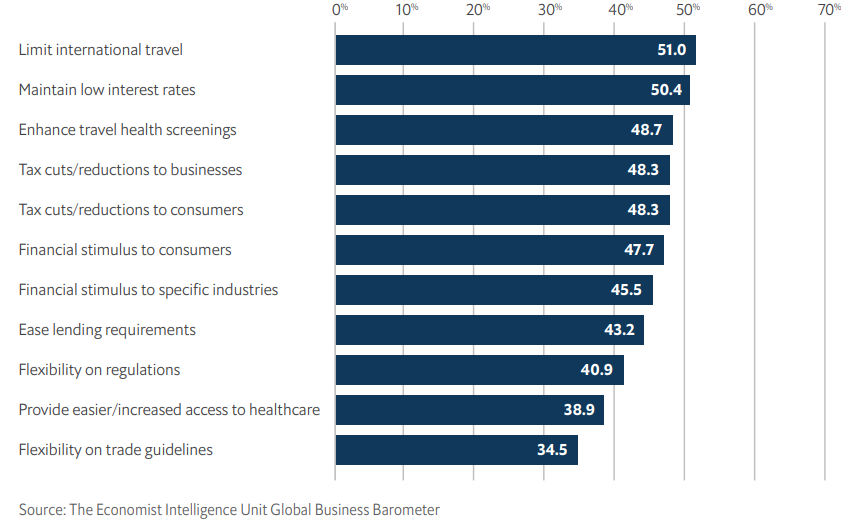

Increasingly alarming for the travel and transport companies that rely on business travellers is the fact that business leaders want Governments to continue limitations on international travel. In a significant shift in just a month, limiting international travel was towards the bottom of the listing of most popular government action to help the economy and business recover in the first edition; in the latest edition it was the top factor receiving 51% of responses.

CHART - Limiting international travel is now seen as the main factor to help the economy and business recover Source: The Economist Intelligence Unit's Global Business Barometer (GBB)

Source: The Economist Intelligence Unit's Global Business Barometer (GBB)

This put it ahead of other options such as direct fiscal stimulus to consumers and tax cuts. "Now that travel restrictions have been demonstrably effective in many instances against the spread, we see a mix of resignation and adaptation amongst executives on the issue," explains The Economist Intelligence Unit in the research supported by SAS.

"Teleconferencing services, though imperfect substitutes and not without issues, have proven to be enough for ensuring business continuity, so much so that a large number of firms are offering employees the ability to work from home indefinitely. In addition, road-weary executives report finding lighter travel schedules liberating, perhaps indicating that fewer business trips will prove a persistent trend," says the report.

The Blue Swan Daily highlighted earlier this week that an increasing number of business leaders are seeing the use of technology as a viable alternative to business travel as modern streaming capabilities from companies such as Zoom, Google and Microsoft have come into their own allowing executives to better understand the power of technology and appreciate how it can reduce travel and entertainment expenses.

https://corporatetravelcommunity.com/old-habits-will-reemerge-but-the-impact-of-technology-on-business-travel-could-be-substantial-senior-executives-now-understand-the-power-of-technology-and-appreciate-how-it-can-reduce-trave/

The swing in sentiment over the nature of the global economy is indicative of a recovery that could remain a long way off. The barometer findings show that sentiment in Europe increased the most (from -40.5 to -27.3), followed closely by the Asia-Pacific and North America. Sentiment about the global economy among executives in the Middle East and Africa region, while still up, increased by only 6.9 points, the least among the five regions covered by the barometer.

Interestingly, the biggest single swing in the barometer between the Apr-2020 and May-2020 editions came in China, where the 3-month outlook for the economy fell by 21.9 points. It highlights how fluid the current environment remains and how much uncertainty remains over the Covid-19 pandemic.

As the report highlights, at the time of the first GBB, China looked to be over the worst of Covid-19 (or at least the worst of the first wave). That has clearly since changed, with the mood souring considerably on fears of a second wave, widespread downgrades to China forecasts and the Chinese government abandoning its annual GDP target for the first time in decades.

Maybe business leaders were a little more optimistic when the questions were first fielded during the first edition of the survey and the latest findings are more aligned with their true opinions. Perhaps it simply follows an acceptance of the problems we are facing from the coronavirus pandemic and the acknowledgement that it will be a tough revival.

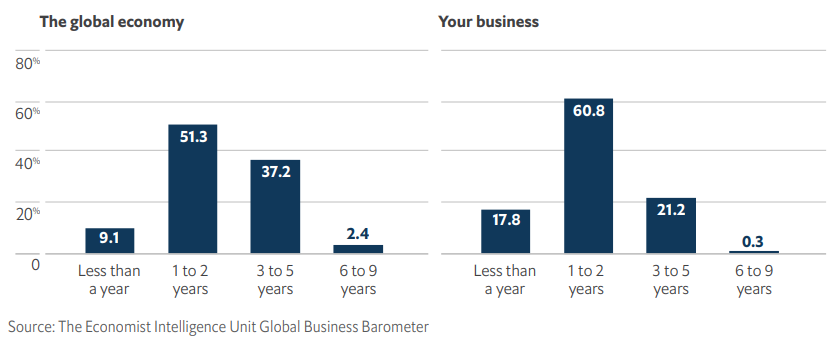

"Adaptation is going to prove increasingly vital the longer recovery takes," says the report. And that could be a lot longer than first imagined. In the latest GBB survey while economic recovery response periods remains steady there was an uptick in the percentage of GBB survey respondents answering that the global economic recovery will take "three to five years," rising from 30.8% to 37.2% over the two editions.

When asked how long it would take for their business to recover, the number of respondents answering "less than a year" fell more than 20 percentage points from the first survey while "one to two years" and "three to five years" increased by 14 and 11 percentage points respectively.

CHART - Business leaders are preparing themselves for a longer recovery period post Covid-19 Source:The Economist Intelligence Unit's Global Business Barometer (GBB)

Source:The Economist Intelligence Unit's Global Business Barometer (GBB)