Understanding aviation markets is CAPA's great strength and passion and this year's high-level Americas Aviation Summit is a forum for debate and discussion of strategic issues facing the region's aviation industry and it is attracting airline and travel industry CEOs from across the Americas region, Asia, Europe and the Middle East.

Articles:

- The Constant Gardener - inside the real world of air service development

- Threats to nix Mexico City's new airport could have serious repercussions for Mexican aviation

- The future of airline retailing is now

- Air capacity in North America set to rise 4% this summer; Austin, Nashville, San Jose see double-digit growth

- China set to displace the US as the world's largest aviation market: it's not a matter of if, but when

Follow the CAPA Americas Aviation Summit on Twitter and join the debate: #CAPASummit

LIVE STREAM - follow the agenda proceedings: REGISTER for updates

13:30 - CAPA Americas Aviation Summit 2018 … DONE!

A big thank you from all of the CAPA - Centre for Aviation team to everyone who attend the CAPA Americas Aviation Summit 2018 at the Hilton Americas Hotel in downtown Houston as well as all the sponsors that made the event possible. We hope you enjoyed all the insightful discussions whether in attendance in London, via our live stream or from following the blog.

Tuesday 17-Apr-2018

13:00 - The Great Debate has been exactly that!

Any discussion on Open Skies is sure to generate a lively debate, more so when the United States of America is at the table. 'The Great Debate' has been no different.

https://twitter.com/CAPA_Aviation/status/986295850195406848

https://twitter.com/CAPA_Aviation/status/986296202563112961

https://twitter.com/CAPA_Aviation/status/986297131593031680

https://twitter.com/CAPA_Aviation/status/986299647873429509

Tuesday 17-Apr-2018

12:30 - CAPA Americas Aviation Summit is facilitating reunions...

https://twitter.com/ZeBirdman/status/986295179769458689

Tuesday 17-Apr-2018

12:00 - Up next... The Great Debate: The future of Open Skies agreements

We reach the summit of the summit and our last session... The Great Debate

When the US government first began promoting Open Skies agreements, the concept met considerable opposition from airlines. Many carriers were accustomed to restricted-entry markets, had made major investments in building lucrative international markets, and feared inroads into their home markets, where they often enjoyed dominance. Governments were quite used to trading for a balance of benefits, leading often to tit-for-tat-you want something for your carriers, we get something for ours. Consumers were often left behind.

Open Skies not only relaxed pricing and capacity controls, but also made it possible to serve many more points behind the previously restricted number of international gateways. In doing so, it reduced the proportion of beyond-gateway domestic connections. Another by product was to enable much more extensive sixth freedom operations internationally.

US leadership across Administrations to forge Open Skies agreements transformed air travel. Prices dropped. Alliances were formed. Both legacy airlines and low cost carriers entered new markets. New routes were opened, many that would have never been possible without Open Skies and metal-neutral alliances with antitrust immunity. Open Skies spread throughout Europe, to Canada, Latin America, Asia Pacific, and Africa. Cargo carriers established new distribution hubs in the Middle East and Asia, with few access constraints. Airlines have available a wide array of open skies markets with fifth (and sometimes seventh) freedom rights, although, outside North Asia, the rights are rarely exercised.

But have we witnessed the zenith of international liberalism in aviation, with protectionism rearing its head. Will the drum beating in Washington DC for international trade wars with China, Russia, and others spill over into aviation? Will Middle East politics serve to isolate some countries, with winners and losers? Will calls from Big 3 US airlines for retaliation against alleged airline subsidies in the Middle East lead to more than consultations? Will cargo and fifth operations be targets? In a broad atmosphere of economic nationalism and Trump Administration calls for tariffs, with a willingness to endure trade wars with one of its largest trade partners, what does the future hold for Open Skies?

In Europe, the EU is sharpening its competition tools to face Gulf carrier challenges. The EC appears set to revamp laws enabling it to impose duties on non-EU airlines or suspend flying rights if it finds unfair trade practices involving subsidies, slot allocation, ground handling services, airport charges, refuelling, etc.France, Germany and Italy appear more protective than the UK, which has typically led the liberalisation charge. As the UK exits the EU under Brexit, and its future role remains unclear, will the EU position change? This panel will explore these and other questions, including:

- How important is it that governments work to ensure a level playing field in aviation?

- Could US airlines take greater advantage of the market access opportunities they have available under existing agreements?

- Is the dispute among the Gulf Carrier States, Europe, and the US likely to spill over to other trade or geographical areas, or trigger a retrenchment against Open Skies?

- What impact will President Trump's trade policies likely to have on aviation?

- As China becomes a major market, is an Open Skies agreement likely - or necessary, to secure JV authority?

- Is there a global trend to rolling back open skies?

- What is the likely outcome of UK-EU and UK-US Open Skies' talks?

Tuesday 17-Apr-2018

11:30 - Key insights on digital disruption and airline distribution

https://twitter.com/CAPA_Aviation/status/986279778826309633

https://twitter.com/CAPA_Aviation/status/986278320772874246

https://twitter.com/CAPA_Aviation/status/986279778826309633

Tuesday 17-Apr-2018

11:15 - Up next... Embracing digital disruption in airline distribution

Most airlines appreciate that technology is radically changing marketing and distribution models, yet the structure of airlines remains focused on the business of flying metal. How should airlines prepare for this brave new world in which ambitious technology upstarts and intermediaries - constantly interrupted by the informed consumer - retain their (sometimes limited) control over distribution?

Airline management teams will need to undergo the requisite paradigm shift and innovate their marketing and distribution strategies to position their companies as retailers in the digital realm.

- Data is power - why airlines should start behaving like tech companies

- With the harnessing of big data, how important are online consumer channels like Amazon, Facebook, Alibaba, Airbnb becoming?

- What kinds of low cost automated distribution channels should airlines invest in?

- What is the future role for the GDSs?

Tuesday 17-Apr-2018

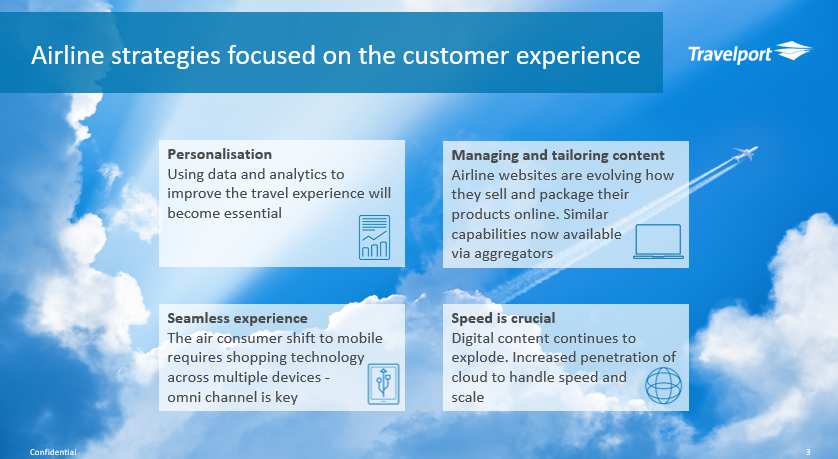

11:10 - Travelport: The way forward … embrace the opportunity ... industry collaboration is key

Tuesday 17-Apr-2018

11:05 - Airline strategies focused on the customer experience

Responding to the increased competition, traditional airlines are focusing on strategies that enhance the customer experience, says Travelport, Senior Commercial Director, Air Commerce, Craig Banks.

Tuesday 17-Apr-2018

11:00 - From The Blue Swan Daily... The Constant Gardener - inside the real world of air service development

Aviation provides the only worldwide transportation network, which makes it essential for global business and tourism. As such it also plays a vital role in facilitating economic growth, particularly in developing countries and even a single new route can deliver significant benefits. Competition for securing new air services is increasingly intense as airports fight for airlines' aircraft capacity. But, senior officials on a panel discussion at the CAPA - Centre for Aviation Americas Aviation Summit 2018 make comparisons between the multi-billion dollar industry to gardening!

https://corporatetravelcommunity.com/the-constant-gardener-the-real-world-of-air-service-development/

Tuesday 17-Apr-2018

10:50 - From The Blue Swan Daily... Air capacity in North America set to rise 4% this summer; Austin, Nashville, San Jose see double-digit growth

Air capacity within and from North America is scheduled to rise by around 4.0% this summer with an additional 28 million departure seats available versus summer 2017. The region's top 50 airports will be responsible for over two thirds of that growth adding over 20 million seats between them alone.

Analysis by The Blue Swan Daily of OAG schedule data for the current summer 2018 schedule shows Norman Y Mineta San Jose International Airport in California, USA is set see the largest growth (+14.4%), with Austin-Bergstrom International Airport (+11.6%) and Nashville International Airport (+10.6%) also seeing double-digit rises. Growth among the Top 50 airports will track slightly behind the region average at +3.6% with only eight of the region's top 50 airports seeing a decline in summer capacity, most by less than -1%.

Seattle-Tacoma International Airport will be responsible for the largest increase in capacity and one of five top 50 North American airports to boost its summer inventory by more than one million seats.

https://corporatetravelcommunity.com/air-capacity-in-north-america-set-to-rise-4-this-summer-austin-nashville-san-jose-see-double-digit-growth/

Tuesday 17-Apr-2018

10:40 - Up next... Distribution and Big Data

We now move away from our early morning focus on ULCCs to look at distribution and big data and presentations on 'Changing landscape of airline distribution' from Travelport senior commercial director, air commerce, Craig Banks and 'Leading Airline Operations into the Digital Age' from Fisher College of Business executive-in-residence & airline business strategist, Nawal Taneja.

Tuesday 17-Apr-2018

10:30 - More content from this morning's ULCC discussion

https://twitter.com/CAPA_Aviation/status/986265567735832578

https://twitter.com/Anitaaviation/status/986265085969657861

https://twitter.com/CAPA_Aviation/status/986261167726309376

Tuesday 17-Apr-2018

10:20 - A pictorial guide to day one at the CAPA Americas Aviation Summit

https://corporatetravelcommunity.com/a-pictorial-guide-to-day-one-at-the-capa-americas-aviation-summit/

Tuesday 17-Apr-2018

10:10 - ULCC insights - key quotes from today's first panel session...

"It's a simple formula. You take the various pieces to build a model that can compete with anybody in the market."

Indigo Partners, managing partner, William Franke

"We often talk about turning left when boarding an aircraft, but we want you to turn right."

Indigo Partners, managing partner, William Franke

"Our Airbus order gives us a clear long-term cost advantage against anyone committing to a smaller aircraft order."

Indigo Partners, managing partner, William Franke

"VivaColombia load factors have been much higher than anything else we have seen."

Irelandia Aviation, member of the advisory board, Tony Davis

"There's a disproportionately high number of birds that like flying into our engines across Latin America."

Irelandia Aviation, member of the advisory board, Tony Davis

Tuesday 17-Apr-2018

10:00 - A CAPA Americas debut for a new type of carrier - the 'tweener' airlines!

https://twitter.com/Anitaaviation/status/986258205981528064

Tuesday 17-Apr-2018

09:50 - Join the debate! More content from #CAPASummit

https://twitter.com/danibertollini/status/986251840592457728

https://twitter.com/volantio/status/986251136960262152

https://twitter.com/iah/status/986057765889060864

Tuesday 17-Apr-2018

09:45 - Up Next... The ULCCs are coming! A future force in the Americas

Unlike Asia and Europe, US, Canada and Latin American LCC activity has been relatively muted in recent years. Although it was the home of the breed, the US has slipped well behind as airline bankruptcies and consolidation allowed the US majors to reduce costs significantly and to dominate the market more actively.

Technically, the US has a high level of LCC activity, but much of that consists of Southwest's presence; the once market leader of LCCs now occupies a cost base very similar to its major full service rivals. Aside from Mexico, (where two thirds of domestic seats and a quarter of international are on LCCs), and Brazil (almost 60% of domestic operations), Latin America overall has relatively low LCC penetration. That is all now about to change across the region. Canada has new LCC entrants and both major airlines have established lower cost subsidiaries.

To the south, countries like Chile, Colombia and even Argentina are now experiencing a tidal shift as ULCC groups spread across borders. But in many areas of Latin America particularly, despite the elements already being in place for effective market stimulation, a lack of adequate airport infrastructure and prohibitively high costs constitute barriers to entry faced by LCCs.

The reappearance of "ULCCs" in the US has sufficiently worried the majors to provoke them to adopt various price matching competitive strategies. And ultra-low cost groups like Indigo Partners/Frontier/Spirit are challenging the status quo, as is JetBlue in a hybridised fashion. With many medium sized airports anxious for a return of services, opportunities abound.

For the time being the LCCs and ULCCs are attacking the lower hanging fruit, but there are many opportunities that are not being fully exploited at present.

Tuesday 17-Apr-2018

09:30 - Bill Franke: "You have to expect the LCC and ULCC model to grow"

William Franke, managing partner at Indigo Partners, sees LCC and particular ULCC growth opportunities across the Americas.

In the USA he notes that "you have to expect" the model to develop given the limited penetration versus that seen across the pan-European market.

In Canada he questions the formation of Air Canada Rouge and Swoop from WestJet as history shows an airline within an airline concept has very little success as costs migrate." However, he does see the potential for a clean slate ULCC, albeit foreign ownership issues makes it difficult to raise capital.

Across Latin America he sees a "favourable market" for ULCC development. "It is pretty clear to me they will deepen their position in existing markets" with ULCCs "motivated to unlock demand with low fares to stimulate passengers". For Franke this market remains an "exciting opportunity" and sees further extensions of brands across region like we have already seen with Volaris in Costa Rica, VivaColombia in Peru and jetSMART growing beyond Chile to now serve Peru.

Tuesday 17-Apr-2018

09:15 - From Tigers in Asia, a Wizz across Europe, Indigo Partners has now found a new home in the Americas

William Franke, managing partner at Indigo Partners needs no introduction at an aviation event and we have a packed house this morning to listen to his expert views on the Ultra Low Cost Carrier (ULCC) model. Look out for a full story on The Blue Swan Daily later today.

Tuesday 17-Apr-2018

08:00 - A look back at last night's gala dinner

Visit the CAPA - Centre for Aviation Facebook page to see images from last night's gala dinner at Minute Maid Park.

Tuesday 17-Apr-2018

07:00 - Howdy from Houston y'all! We're back for day two at The CAPA Americas Aviation Summit

Good morning from the Hilton Americas hotel in Houston where things are currently quiet ahead of today's 9am start of the formal agenda and the not-to-be-missed keynote from one of the fathers of the ULCC industry, William Franke, managing partner of Indigo Partners.

Monday 16-Apr-2018

22:00 - A message from the Mayor

https://twitter.com/SylvesterTurner/status/986092755419058177

Monday 16-Apr-2018

19:30 - Houston and Harbison hit home runs!

CAPA - Centre for Aviation executive chairman, Peter Harbison, and the rest of the CAPA event team are mingling with delegates at tonight's dinner reception at Minute Maid Park.

Monday 16-Apr-2018

19:00 - CAPA Americas Aviation Summit 2018 on Linkedin

Monday 16-Apr-2018

18:00 - Join the debate! - more from #CAPASummit

https://twitter.com/AirlinkFlight/status/986023978065170432

https://twitter.com/danibertollini/status/985971640864518144

https://twitter.com/atgarland/status/985983139788001280

Monday 16-Apr-2018

17:25 - Countdown to cocktails at the ball park

That's the end of the conference agenda on day one of the CAPA Americas Aviation Summit 2018, but it is not the end of the day's programme, which will continue with a dinner reception hosted by Houston Airports at Minute Maid Park, home of the Houston Astros baseball team. Here's a sneak peak...

Monday 16-Apr-2018

17:15 - The constant gardeners - air service development insights

https://twitter.com/CAPA_Aviation/status/985998538701127682

https://twitter.com/CAPA_Aviation/status/985999275430625282

https://twitter.com/CAPA_Aviation/status/986000928959479810

https://twitter.com/CAPA_Aviation/status/986002123581145093

https://twitter.com/CAPA_Aviation/status/986002695390547968

Monday 16-Apr-2018

16:30 - Next up... How can airports attract new air services - and differentiate their attractiveness?

In recent years airports around the world have become much more active participants in the aviation equation. They have engaged airlines at the network planning level and, often together with local business and tourism interests, offered incentives for new air services. The advent of smaller wide and narrow body aircraft also are suddenly introducing new prospects, long and short haul, introducing city pair opportunities that would never have been viable in the past.

Inevitably geographic position plays a large part in an airline's decision whether or not to fly to an airport, but there are many other factors at play. In the US, a large number of airports have suffered reduced service post-consolidation and are actively seeking both domestic and international airlines to rebuild their traffic. There can be extensive synergies between domestic and international operations in terms of locking them in for the long term, so the process of attracting new business can require sophisticated market solutions.

Some of the new "experimental" international routes in particular can be fragile, as has been illustrated recently. Differentiating the offering is one aspect. Aside from ensuring they have the appropriate facilities, fee structure and services to meet the needs of their airline customers, there is huge untapped potential for airports to share data and co-operate commercially with airlines for mutual benefit; this could prove a key factor in attracting and retaining carriers assessing the viability of a new route.

Monday 16-Apr-2018

16:00 - Insights from foreign ownership discussion

https://twitter.com/CAPA_Aviation/status/985985088654577667

https://twitter.com/CAPA_Aviation/status/985987309559361536

Monday 16-Apr-2018

15:30 - Up next... Should the US relax foreign ownership rules for domestic airlines?

In our penultimate session of the day we look at the subject of foreign ownership rules. The US applies one of the most restrictive regimes for foreign ownership of airlines of any developed country. While there is a great deal of rhetoric surrounding the reasons for this, there has not been a great deal of empirical evidence that it is in the national interest - or even that of the incumbent domestic airlines themselves. One argument sometimes raised is that in times of strategic emergency a largely foreign owned airline might not be available for national uplift.

Pilot and other unions have been particularly strenuous in their opposition to increased foreign ownership. Here again there appears to be no generic reason for their resistance to change, other than unsubstantiated claims of the possibility of lower paid workers being introduced. Meanwhile some US airlines have taken advantage of other countries' rules to acquire up to 49% of their national airlines in order to strengthen their market position.

Monday 16-Apr-2018

15:15 - What's in store after our afternoon refreshment break?

https://twitter.com/Holland_Knight/status/985971368306053127

Monday 16-Apr-2018

15:00 - A charitable message from Airlink - disaster response delivered

Airlink is a rapid-response humanitarian relief organisation that links airlines with pre-qualified nonprofits. Today, Airlink's network consists of more than 35 commercial and charter airlines and 80+ international nonprofits.

Since its inception in 2010, Airlink has worked with its airline partners to respond to a number of rapid-onset disasters, including the earthquake in Haiti, the tsunami in Japan, Hurricane Sandy and numerous tornadoes in the US, Typhoon Haiyan in the Philippines, and the Ebola crisis in West Africa. In addition, Airlink's airline partners have assisted many organisations in addressing ongoing issues in the developing world, such as access to clean water, food, shelter, medical aid, and education.

Airlink and its airline partners have transported over 4,000 passengers and more than 3,000,000 pounds of cargo in support of a broad range of humanitarian initiatives. Airlink estimates the value of these movements at more than USD $6,000,000.

Monday 16-Apr-2018

14:45 - Time is more significant than price in persuading passengers to switch flights

Research by Volantio, a leader in travel technology software focused on revenue and capacity optimisation for airlines, has found that price is not the biggest driver in persuading passengers to move between flights, reveals the company's chief executive officer, Azim Barodawala. He says: "What makes a passenger flexible moving from one flight to another? Price is the fourth most important factor, that was incredibly surprising to us." Ranked ahead of it were the number of passengers on the PNR; difference in travel time; how far in advance the change occurs.

Monday 16-Apr-2018

14:30 - Join the debate! More from #CAPASummit

https://twitter.com/_sam_miller/status/985930208770392064

https://twitter.com/danibertollini/status/985952602142773249

Monday 16-Apr-2018

14:25 - Up next... All's 'fare' in love and war: is aggressive pricing a new competitive reality?

Bankruptcy and subsequent consolidation have delivered the majors a low cost base and strong market positions, especially at their main hubs. But a combination of lower fuel prices and a resurgence of low price competition has created downward pressures on yields over the past year.

These may be recoverable, but there is a constant threat of ULCC entry on city pairs that have been lost as major airlines consolidated - a network phenomenon that occurred in Europe and Asia as LCCs have successfully gained dominant positions. Compared with other developed regions there is relatively lower connectedness for medium sized airports since consolidation.

As those airports (and their local economic interests) become more aggressive in their marketing activities, and as ULCCs expand, a new network and pricing dynamic will appear. Unlike their Asian and European full service peers - who are much more exposed to LCC pressures - US airlines have not resorted to establishing low cost subsidiaries. Instead they have used various pricing strategies on their mainline operations. To date this appears to have been successful. As low cost competition grows and the majors' cost bases rise, this may call for new responses.

Monday 16-Apr-2018

14:20 - "It's not comparing apples with apples, not even oranges with tangerines"

Various links are being made between the emergence and evolution of the low cost long haul model across the trans-Atlantic and the model already established in the Asian market, but Brian Hedberg, director of Office of International Aviation at the US Department of Transportation (DOT) says that can't be compared. "It's not comparing apples with apples, not even oranges with tangerines," he says.

Monday 16-Apr-2018

14:10 - Join the debate! Share your thoughts

A very valid point has been made from outside of the summit...

https://twitter.com/decfryan/status/985956028582854656

Monday 16-Apr-2018

14:00 - more via Twitter from this afternoon's lively North Atlantic session and especially the subject of low cost long haul

https://twitter.com/CAPA_Aviation/status/985955033333235712

https://twitter.com/CAPA_Aviation/status/985955830024556545

https://twitter.com/CAPA_Aviation/status/985956518129528832

Monday 16-Apr-2018

13:45 - A moderator's opinion on the North Atlantic and Brexit

Moderators should be generally seen and not heard, but that can never be said about Brian Havel, Professor of Law at McGill University who shares his views on both the North Atlantic and Brexit with the summit audience ahead of the panel session. Here's some views from his 15 minute introduction...

https://twitter.com/CAPA_Aviation/status/985952517925343232

https://twitter.com/CAPA_Aviation/status/985953154905800704

Monday 16-Apr-2018

13:30 - Up next... Finding a new regime on the North Atlantic - as regulatory and operating norms change

The afternoon session commences with a panel discussion on the North Atlantic. According to IATA, the North Atlantic provides the world's most profitable major international traffic flow. It is also the most tightly held, with three groups effectively controlling over three quarters of the seats and the bulk of the premium market. After several years of open skies on the North Atlantic and the introduction of LCCs such as Norwegian in its various incarnations, the impact of Brexit now requires a renegotiation of the agreement to restore the UK to open skies once it leaves the EU.

Monday 16-Apr-2018

13:10 - From The Blue Swan Daily... American Airlines leads the way as one of just 13 global airlines defined as an 'advanced e-commerce carrier'

US major American Airlines is the most digitally advanced e-commerce carrier, according to a study by SkaiBlu, an e-commerce consultancy advising airline industry clients in the development and implementation of digital strategies. It is one of 13 global airlines that are considered an 'advanced e-commerce carrier" due to their superior digital capabilities, a list includes fellow US majors Delta Air Lines and United Airlines, plus Alaska Airlines, JetBlue Airways and Southwest Airlines.

https://corporatetravelcommunity.com/american-airlines-leads-the-way-as-one-of-just-13-global-airlines-defined-as-an-advanced-e-commerce-carrier/

Monday 16-Apr-2018

12:50 - From The Blue Swan Daily... IATA: infrastructure, costs and the regulatory framework need to be the focus for Latin America and Caribbean governments

The International Air Transport Association (IATA) has called on the governments of Latin America and the Caribbean to focus on infrastructure, costs and the region's regulatory framework to help maximise the economic and social benefits of aviation while accommodating the region's expanding demand for air connectivity. Aviation already plays an important role in the region's economy, employing some five million people and supporting USD170 billion in GDP.

https://corporatetravelcommunity.com/iata-infrastructure-costs-and-the-regulatory-framework-need-to-be-the-focus-for-latin-america-and-caribbean-governments/

Monday 16-Apr-2018

12:40 - Catch up with latest insights from The Blue Swan Daily

As we take a break for lunch, catch up with some recent insights from The Blue Swan Daily...

There has been a 30% rise in App fraud in Q1 2018 and the travel industry is among the hardest hit

Fraud in the mobile app ecosystem is rampant and evolving faster than ever, but what is less known is just how sophisticated fraudsters have become in their attempts to bypass protective measures, how hard they are hitting and who is most exposed. Worryingly, but perhaps unsurprisingly, the travel sector is among the hardest hit.

What does the travel industry really have to gain from blockchain?

Ah, bitcoin - the first decentralized cryptocurrency. Nine years have passed since its inception, yet the perceptions of it could not be more clouded. Bitcoin has been on the receiving end of mixed feedback from its investors, financial institutions, regulators, banks and - more recently - the general public. Comments on the digital asset range from it being forward thinking and innovative to being a 'bubble', or even a pyramid scheme.

A passenger traffic rebound, record load factors and freight rises make it a fabulous February of flying for world's airlines

The International Air Transport Association (IATA) has announced strong global passenger and freight traffic results for Feb-2018. Traffic levels in the passenger market rebounded following slower demand experienced in Jan-2018, while freight traffic is off to its strongest start to a year since 2015.

Monday 16-Apr-2018

12:30 - "Aviation is not a cash cow!"

https://twitter.com/CAPA_Aviation/status/985933528704700422

Monday 16-Apr-2018

12:25 - Have you ever wondered why Volaris does not serve Honduras?

Volaris, chief executive officer, Enrique Beltranena Mejicano explains why the Mexican LCC has not launched flights into Honduras...

"I am asked why we don't fly into Honduras. The answer is simple... I can't with USD38 in taxes in a market where we cannot generate massive growth," he says.

Monday 16-Apr-2018

12:15 - Southwest sees Mexico City as potential growth market when business and VFR demographic becomes a focus

Southwest Airlines, executive vice president & chief revenue officer, Andrew Watterson acknowledges that Mexico City is a market on the LCC's radar as its international expansion continues. After its current focus on leisure destinations, it sees opportunities to expand in business and VFR markets in the future. "That is when the likes of Mexico City will become important for us," he says.

Monday 16-Apr-2018

12:10 - Understanding the concerns over the new Mexico City Airport debate

Here's some background on the subject that was featured on The Blue Swan Daily last month...

https://corporatetravelcommunity.com/political-threat-clouds-new-mexico-city-airport-project/

Monday 16-Apr-2018

12:05 - The new Mexico City debate turns its political propaganda

A political threat has emerged to the new Mexico City International Airport, which is currently under construction in a nature reserve on Lake Texcoco, at a cost of over USD9 billion, down from an original estimate of USD14 billion. It is scheduled to open in Oct-2020 and predicted eventually to become the gateway to the whole of Latin America. But, a General Election to be held in Mexico on 01-Jul-2018 could block development.

"We need a new airport as there is a limitation on capacity and we cant't fly into the system," says Enrique Beltranena Mejicano, CEO, Volaris. The LCC has grown away from the congested Aeropuerto Internacional Benito Juárez but will be impacted by any change in strategy. However, the executive notes that realistically it is not about whether the airport will be built of not under a new political regime. "It is no longer about building the airport as runway would already be completed by the time such a decision will be taken," he adds.

Monday 16-Apr-2018

12:00 - Understanding the regulatory environment with a Latin beat

Latin America has long been the backyard for US airlines of all sizes. As a high potential growth market, its outlook is quite different from the Asian profile. Already US airlines have secured significant equity holdings and partnerships, in attempting to subdue some of the more difficult elements of competition.This has been possible as several key Latin American countries, such as Mexico, Brazil, Chile and now Argentina have adopted relatively liberal aviation policies.

Ownership and control and foreign equity ownership have been significantly relaxed in several cases. Only a small number of states including those of central America have resisted this trend. As the main Latin economies emerge from the difficult times they have experienced in this decade, there is the potential for US airlines to establish even stronger ties.

Monday 16-Apr-2018

11:55 - The Tokyo airport conundrum - which delivers the better business?

https://twitter.com/CAPA_Aviation/status/985923844723658752

Monday 16-Apr-2018

11:50 - Is Air China a genuine hub operator? Is there a level playing field between USA and China?

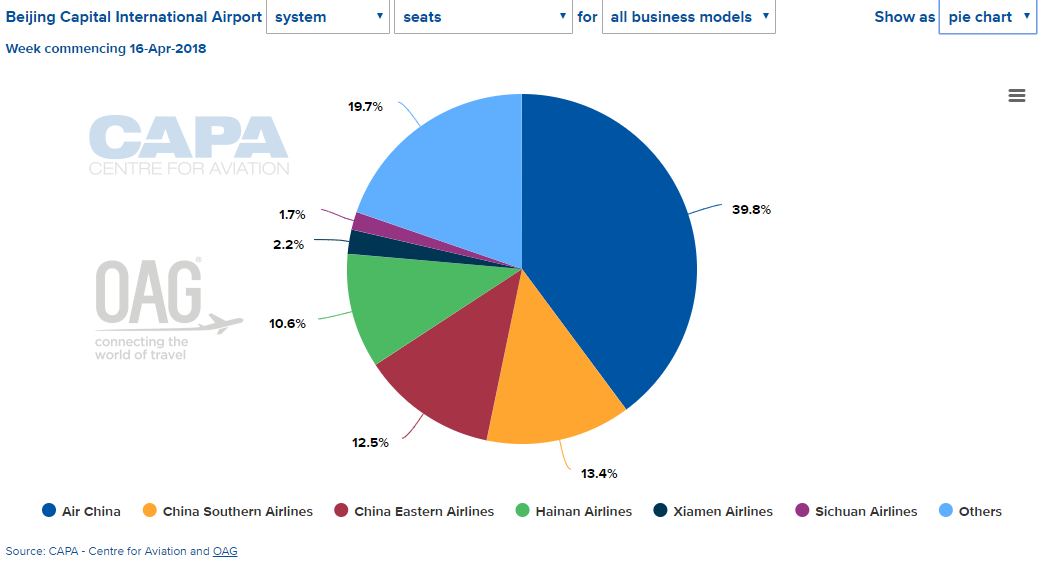

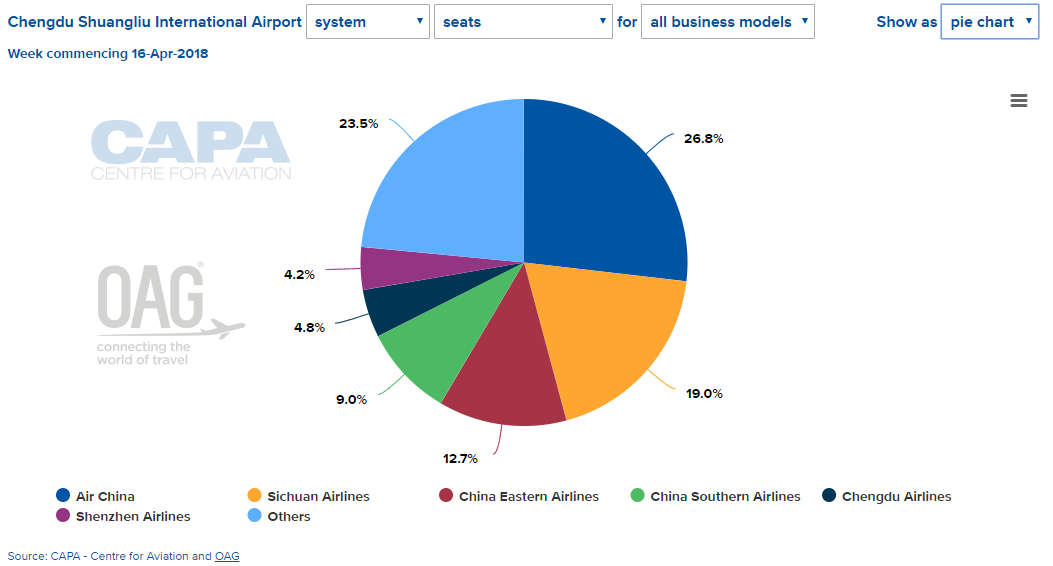

Dr Zhihang Chi, vice president & general manager, North America of Air China believes there IS a level playing field between the USA and China. "We are facing the same constraints," he says and notes that Air China has a much reduced share of capacity at both Beijing Capital International and Changdu Shuangliu International is much lower than US majors see at their respective hubs.

A closer look at CAPA data confirms this with the airline this week only holding a 39.8% share at the Beijing and a 26.8% share at the Chengdu airports.

Monday 16-Apr-2018

11:40 - Houston has been a strong market for Air China as part of its recent explosive growth in the US

https://twitter.com/CAPA_Aviation/status/985919000994607104

Monday 16-Apr-2018

11:30 - JAL: our main concept is to "polish the quality" of our full service carrier

Japan Airlines, vice president marketing & strategy research, Asia & Oceania region, Akihide Yoguchi says the carrier will continue to focus on delivering a full service offering to passengers. "Our main concept is to polish the quality of our full service carrier," he explains, but notes that "the reality of the market" and its evolution means it can not rule out growing into the low cost long haul arena. "We have to look into every aspect," he says.

Monday 16-Apr-2018

11:15 - Photographs from last night's welcome reception

Make sure you visit the CAPA - Centre for Aviation Facebook page to see more images from last night's welcome reception.

Monday 16-Apr-2018

11:00 - A focus on China and Japan, two key markets in and out of North America

Asia's airlines are continuing to embark on what they consider to be once-in-a-lifetime long haul growth. Nowhere is this more significant than in mainland China, whose airlines have been busily opening over 100 new intercontinental destinations since 2006. Japan too remains a key market, still retaining a strong proportion of premium travel and relatively high leisure yields. Under the US-Japan open skies regime, JVs can be forged - at least between the respective oneworld and Star Alliance partners.

Monday 16-Apr-2018

10:45 - Next up... exploiting the regulatory toolbox in higher growth markets: JVs, equity ownership, alliances, codeshares, sixth freedom partnerships…

After a short networking break, our next two sessions, which will take us through to lunch, will focus on high growth markets and links between North America and Asia and Latin America.

The US majors understandably prefer to focus efforts on the lucrative domestic market and on international routes where it is possible to exert dominance, either bilaterally or for example through closed, immunised JVs, with or without equity ownership. The high growth markets of the next decade tend not to offer the same level of commercial certainty, so new strategies are needed if the US airlines are to tap these opportunities. Paradoxically, these seem likely to depend on continuing liberalisation of the market place.

Monday 16-Apr-2018

10:30 - More quotes from our first panel session on the US domestic market

"It will no longer be about airlines selling seats, but solutions to mobility problems. Providing seats is just one component. It is not that far away as technology grows at such a rapid rate."

Fisher College of Business, Executive-in-Residence, Nawal Taneja

"Welcome to America... now join the back of the queue."

Spirit Airlines, senior vice president & chief commercial officer, Matt Klein

"When you see the rain outside you can see the problem. It is when it clears and you can no longer see the issue as you wait as number 47 for take-off, and then sit on the aircraft for 90 minutes."

Southwest Airlines, executive vice president & chief revenue officer, Andrew Watterson

Monday 16-Apr-2018

10:15 - More from #CAPASummit on this morning's sessions

https://twitter.com/danibertollini/status/985895481795596288

https://twitter.com/aviacion21/status/985891495336128512

Monday 16-Apr-2018

10:00 - Key quotes from our first panel session on the US domestic market

"An amazing array of disruptive practices coming online are just one of a number of factors influencing the aviation sector. We are on the cusp of a new era and a sea change".

Trinder Aviation & Aerospace Advocacy, PLLC, president & CEO, Rachel Trinder

"There is a lot of review that is necessary in the US market space. It is not necessary broken though."

Spirit Airlines, senior vice president & chief commercial officer, Matt Klein

"Is US domestic market broken? I don't think so."

Southwest Airlines, executive vice president & chief revenue officer, Andrew Watterson

"This industry never has stability. Who knows what the next speed bump will be and how we can handle it. It is all about the unknown unknowns."

Southwest Airlines, executive vice president & chief revenue officer, Andrew Watterson

"Sometimes you don't need to privatise the whole airport. Sometimes it should just be a terminal."

InterVISTAS Consulting, executive consultant, Kenneth Currie

Monday 16-Apr-2018

09:40 - Up next... The US domestic airline system is broken. Can it be fixed?

As aviation infrastructure - on the ground and in the air - appears stuck in a time warp, the future of US domestic aviation looks perplexing. Funding for airport improvement, in what the President has described as often "third world" airport standards, has not been forthcoming. Despite much talk, there appears to be little progress towards finding adequate methods or resources to supplement an already complex funding system, compounded by federal-state bickering and taxes that are both unhelpful and unproductive.

Monday 16-Apr-2018

09:35 - IAG interest in Norwegian highlights "shift in strategy" on global scale

Peter Harbison, executive chairman, CAPA - Centre for Aviation, highlights that last week's announcement that IAG, parent of British Airways, Iberia, Aer Lingus and Vueling, has acquired a shareholding in low cost operator Norwegian is "indicator of where the market is going internationally" and shows a "shift in strategy" on a global scale regardless of its future intentions.

Monday 16-Apr-2018

09:30 - Join the debate on social media - latest from #CAPASummit

https://twitter.com/danibertollini/status/985887087219171330

https://twitter.com/iah/status/985885015786643456

https://twitter.com/purpleraider/status/985884698181324800

Monday 16-Apr-2018

09:20 - "The industry is shifting away from premium seating"

Peter Harbison, executive chairman, CAPA - Centre for Aviation gives a taster on the day's discussions as he highlights latest business trends impacting North America and looks at the "shift away" from premium seating as the LCC sector continues to mature. This is being seen across multiple geographical markets from Asia, Europe and Latin America, he explains.

Monday 16-Apr-2018

09:10 - A welcome to the "most diverse city" in the US where quality prevails

Mario Diaz, director of aviation, Houston Airport System, welcomes delegates to the CAPA Americas Aviation Summit in what he describes as the "most diverse city" in the United States of America (USA). It is also only the third city in the world and only city in the US that has two airports with a 4-star or better rating from industry experts Skytrax. "Ultimately, our vision is to provide customers at all of the Houston Airport System facilities with a 5-star experience, and these latest ratings show that our efforts and focus are on the right track," he says.

Together, Houston Airports form one of North America's largest public airport systems and position Houston as the international passenger and cargo gateway to the south central United States and a primary gateway to Latin America. Its three airports consist of George Bush Intercontinental, William P Hobby and Ellington/Houston Spaceport.

Monday 16-Apr-2018

09:00 - Houston, we have lift off!

five... four... three... two... one... we have lift off at the start of a day-and-a-half of key industry discussions.

Monday 16-Apr-2018

08:50 - The countdown commences

It is just ten minutes until the opening of this year's CAPA- Centre for Aviation Aviation Americas Summit. Prepare to hear that Rolling Stones music as CAPA executive chairman takes to the stage for his welcome address.

600 seconds... 599 seconds... 598 seconds....

Monday 16-Apr-2018

08:00 - News from #CAPASummit

https://twitter.com/volantio/status/985697591680798720

https://twitter.com/skyscannerptrs/status/985876716206919680

https://twitter.com/CAPA_Aviation/status/985850487084933122

Monday 16-Apr-2018

07:00 - The calm before the storm

It is just a couple of hours until the formal agenda starts on day one of the CAPA-Centre for Aviation Americas Aviation Summit at the Hilton Americas hotel in Houston and all is quiet in the conference hall and networking areas, although the CAPA team have been beavering away for a couple of hours ensuring a smooth delivery of today's programme.

Sunday 15-Apr-2018

22:00 - Looking ahead to tomorrow's dynamic line-up of speakers

A full day of discussions is in store tomorrow with events kicking-off at 09:05 with a welcome introduction from Houston Airports, director of aviation, Houston Airport System, Mario Diaz, followed by a presentation from Peter Harbison, executive chairman of CAPA looking at the key issues in the US domestic and international aviation markets. Tomorrow's sessions include not-to-be-missed panel discussions including senior representatives of airlines, including... Air China, Allegiant Air, FedEx Express, Japan Airlines, Lufthansa Group, Southwest Airlines, Spirit Airlines, VivaAerobus and Volaris.

Sunday 15-Apr-2018

21:00 - Wait until tomorrow... for debate and discussion of strategic issues facing the region's aviation industry

What will tomorrow bring? A packed schedule of enlightening discussions unrivalled in coverage of the top strategic issues affecting the US domestic and international markets. Subjects include...

- CAPA Aviation Outlook to 2020: Key issues in the US domestic and international aviation markets.

- Panel: The US domestic airline system is broken. Can it be fixed?

- Exploiting the regulatory toolbox in higher growth markets: JVs, equity ownership, alliances, codeshares, sixth freedom partnerships… serving Asian markets... serving Latin American markets.

- Finding a new regime on the North Atlantic - as regulatory and operating norms change

- All's fare in love and war: is aggressive pricing a new competitive reality?

- Should the US relax foreign ownership rules for domestic airlines?

- How can airports attract new air services - and differentiate their attractiveness?

Sunday 15-Apr-2018

20:00 - CAPA industry insights - a tipping point in the trans-Pacific

Asian airlines have been expanding on relatively easy routes where there is strong O&D or a partner hub. But increasingly Asian airlines will now have to enter competitive markets, grow partnerships, and even enter a competitor's hub, says latest analysis from CAPA - Centre for Aviation.

READ MORE: North America-Asia: the future of the trans-Pacific airline market

Sunday 15-Apr-2018

19:00 - A warm greeting at the welcome reception

The wine, beer and champagne was flowing at tonight's welcome reception. Here's some images...

Sunday 15-Apr-2018

18:30 - Texas music legend Bob Livingston sets the tone for the evening

American singer and songwriter Robert Lynn "Bob" Livingston, a founding member of The Lost Gonzo Band and a key figure in the Cosmic Cowboy, progressive country and outlaw country movements that distinguished the Austin, Texas music scene in the 1970s, is performing to delegates at this evening's welcome reception.

https://twitter.com/CAPA_Aviation/status/985663899163856896

Sunday 15-Apr-2018

18:00 - Doors open to welcome reception

Delegates have already started arriving and are enjoying the hospitality of our event host, Houston Airports.

Sunday 15-Apr-2018

17:30 - Behind the scenes - setting up the stage

The stage is being set for tomorrow's insightful discussions.

https://twitter.com/CAPA_Aviation/status/985643564804780033

VISIT the CAPA Americas Aviation Summit landing page for more information about the conference and to view the full event agenda.

Sunday 15-Apr-2018

16:00 - The exhibition area is starting to take shape ahead of tomorrow's formal agenda

Sunday 15-Apr-2018

14:00 - A sunny arrival for delegates in Houston

It is a beautiful day in Houston. Here's a view from the organiser's office...

Sunday 15-Apr-2018

12:00 - Delivering insights on all the industry's key talking

For almost 30 years CAPA - Centre for Aviation has been delivering market intelligence, research and data solutions that support strategic decision-making at hundreds of the most recognised organisations in global aviation. Its unrivalled reputation for independence and integrity underpins the commitment of a global team of experts who deliver a wealth of insightful analysis on the latest developments and trends affecting commercial aviation.

Here are just some of the recent insights available to CAPA members…

North Atlantic aviation market: LCCs grow market share

LCC seat share on the North Atlantic has grown from almost nothing five years ago to 8% in summer 2018, higher than in any long haul market from Europe (LCCs have 1.0% on Europe-Asia Pacific, 1.7% on Europe-sub Saharan Africa, and 3.4% on Europe-Latin America). The dominance of immunised joint ventures involving the leading legacy airlines is being eroded, in no small measure due to LCC expansion. In particular, low cost narrowbody growth is now outpacing LCC widebody expansion in this market.

Gulf-EU open skies: US dispute, fifth freedom and EU negotiations

After a global wave of political conservatism and growing interest in aviation protectionism, is open skies dead? The EC is undertaking contentious negotiations with countries that include the UAE and Qatar. Antagonism towards these aviation hubs has occurred at the same time as European airlines' American counterparts have also taken aim at the Gulf hubs.

Brazil aviation: airlines expand international & domestic capacity

Brazil's three largest airlines are forecast to grow their domestic capacity in 2018 at varying degrees as demand in the country appears to be on a stable upswing, after plummeting during the country's recession that began in 2015. Azul, GOL and LATAM Airlines Brazil believe the country's domestic market is in a period of stabilisation, with corporate demand finally starting to rebound. Azul and GOL both posted healthy increases in ticket prices at the end of 2017, which reflects a level of pricing traction in the market.

Europe summer 2018 airline capacity growth still above 10 year average

Growth in airline seats from Europe will slow to 5.2% in summer 2018, versus 6.2% in summer 2017, according to CAPA analysis of OAG data. This will be the slowest summer growth rate since 2014, but well above the 10 year average of 3.9% for the fifth year running. Within Europe, LCC seat growth will be almost twice non-LCC growth, and Eastern/Central Europe will outpace Western Europe. On the North Atlantic, growth above trend is being driven by LCCs, whose seat share will be 8.0% (versus 3.0% two summers ago), while immunised JV share continues to fall. On Europe-Asia Pacific, accelerating growth is mainly driven by Asian airlines.

Sunday 15-Apr-2018

10:00 - DID YOU KNOW? North America has the largest number of regional aircraft in the world

https://twitter.com/CAPA_Aviation/status/977206847097753600

Sunday 15-Apr-2018

08:00 - DID YOU KNOW? The USA is home to the world's largest domestic air market

https://twitter.com/CAPA_Aviation/status/978380078810791937

Sunday 15-Apr-2018

06:00: Howdy from Houston y'all!

Good morning from the Hilton Americas hotel, conveniently located in the heart of downtown Houston and the venue for this year's CAPA - Centre for Aviation Americas Aviation Summit. The CAPA event team are all on site working hard to prepare everything for the event, which opens tonight with a welcome reception at the hotel.