During Sep-2020, the airline plans to operate roughly 43% of the capacity it deployed into the market a year ago, and by Dec-2020, that level will reach 60%. In Sep-2020, Azul projects operating 404 daily flights to 88 destinations compared with 240 daily flights to 72 cities in Jul-2020.

Notably, the airline is also seeing some traction in pricing, although fares remain lower than pre pandemic levels. "We've seen average fares come up very nicely over the last three to four weeks," says Azul chief revenue officer Abhi Shah. "And the very good news is the volume of demand has held up as those average fares have come up."

However, Mr Shah acknowledges that "we're still waiting for corporate to come back". But he did highlight that there are some green shoots in the corporate sector, noting that Azul recorded improvement in corporate bookings in Jul-2020 versus Jun-2020, and the that sequential improvement as continuing into Jul-2020.

Overall, Azul remains bullish about its prospects, and the opportunities Brazil presents. "You think about everybody doing these Zoom conferences," says Azul CEO John Rodgerson. "That's not happening in the agri business. That's not happening all throughout Brazil and the small cities that we serve. And so I think that's a strength of our network that nobody can really replicate."

The airline has calculated that presently it is the only operator in 85% of its destinations, and has a range of aircraft types that offer flexibility. Azul's fleet includes Cessna Caravans, ATR turboprop Embraer jets and Airbus wide and narrowbodies. The Caravans are part of its new brand, Azul Conecta, which will help it to increase its domestic network to over 200 cities.

Azul's believes its fleet "has flexibility like no other airline in Brazil" and is are using this to its advantage. "We have aircraft ranging from nine seats to 214 seats in domestic markets, which allows us to customise our network to the evolving demand scenario," it explains. It has also reached agreement with Embraer and Airbus to postpone 82 deliveries between 2020 and 2023 to 2024 and beyond.

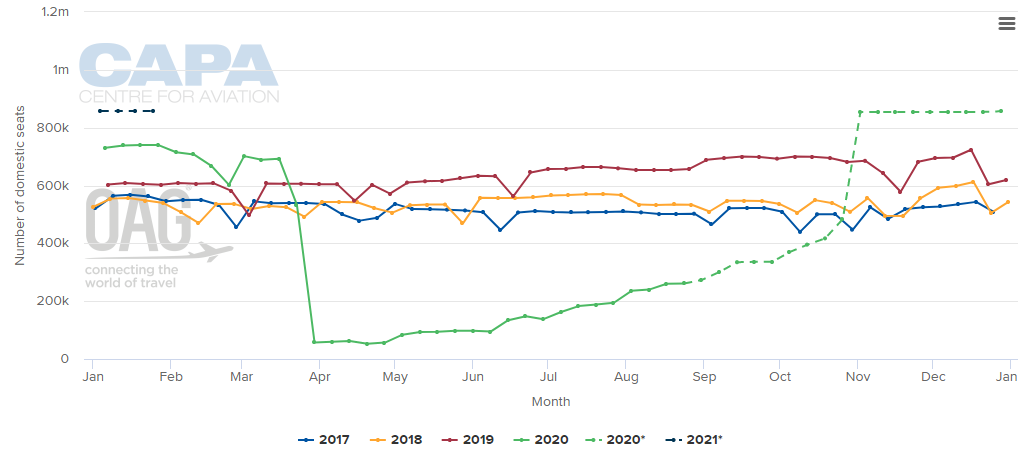

CHART - Azul has seen a clear but shallow growth in its domestic capacity offering since levels dropped at the end of April Source: CAPA - Centre for Aviation and OAG (data: as at 17-Aug-2020)

Source: CAPA - Centre for Aviation and OAG (data: as at 17-Aug-2020)

The 60% projection for the end of the year represents an improvement on the airline's more conservative original forecast that demand would recover to approximately 40% of pre-coronavirus levels and positively shows that demand is recovering faster than expected. Still, the airline is positioning itself for the future. "We are confident in the progress so far and expect this sequential growth to continue as the economy reopens," says Mr Rodgerson.

The readjustments have included the implementation in 2Q 2020 of a new boarding process called 'Tapete Azul', or 'blue carpet', which uses projectors and screens around the boarding area to create a moving carpet image on the floor, guiding customer to board when their row or group is called. Azul says that on average this innovation reduces boarding times by 25% and increases NPS by 21% and by the end of the year, it expect to have this system adopted for 70% of its flights.

The environment has also seen Azul and LATAM Airlines Brasil join forces through a new codeshare agreement which commenced this week. The first stage includes 35 domestic routes, commencing 17-Aug-2020: 23 operates by Azul and 12 by LATAM. The second stage, due to launch later in Aug-2020 will add a further 12 Azul and 17 LATM routes to the arrangement. This mainly focuses on routes from Brasilia, Belo Horizonte, Recife, Campinas, Porto Alegre, Curitiba and Sao Paulo Guarulhos and includes FFP accrual and redemption options across the carriers.