Summary:

- The introduction of non-stop scheduled flights by Qantas between Perth and London mean 2018 will always be remembered as a landmark year in Australia;

- An investigation by The Blue Swan Daily of OAG flight schedule data shows that it was actually a fairly benign year in terms of capacity growth;

- As Australia basks in summer sunshine, schedules for the first three months of the year share a cautionary prognosis for 2019.

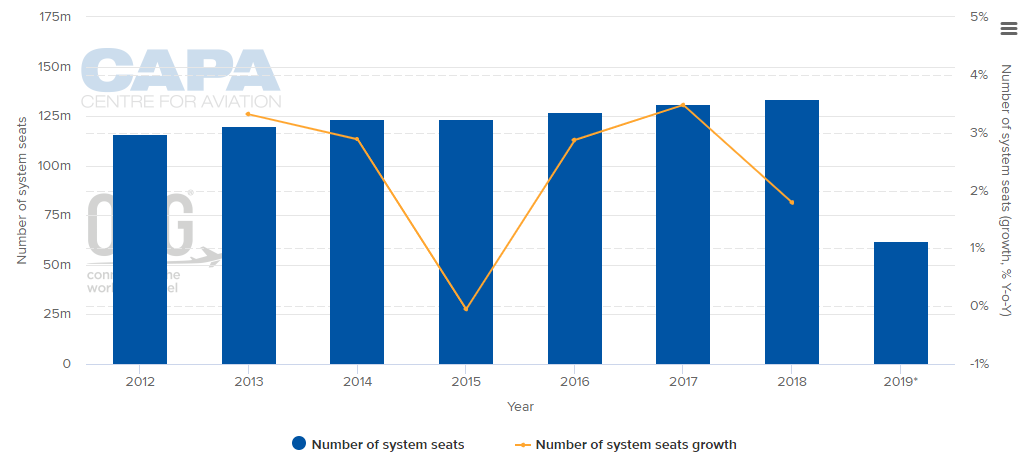

An investigation by The Blue Swan Daily of OAG flight schedule data shows that it was actually a fairly benign year in terms of capacity growth with system seats growing at their slowest rate since 2015, when a small -0.1% year-on-year decline was actually recorded. The 1.8% system capacity growth in 2018 is fairly solid in what is a mature air services market, but is almost half the growth rate recorded in 2017 (3.5%) and also down on the 2016 (2.9%) rate.

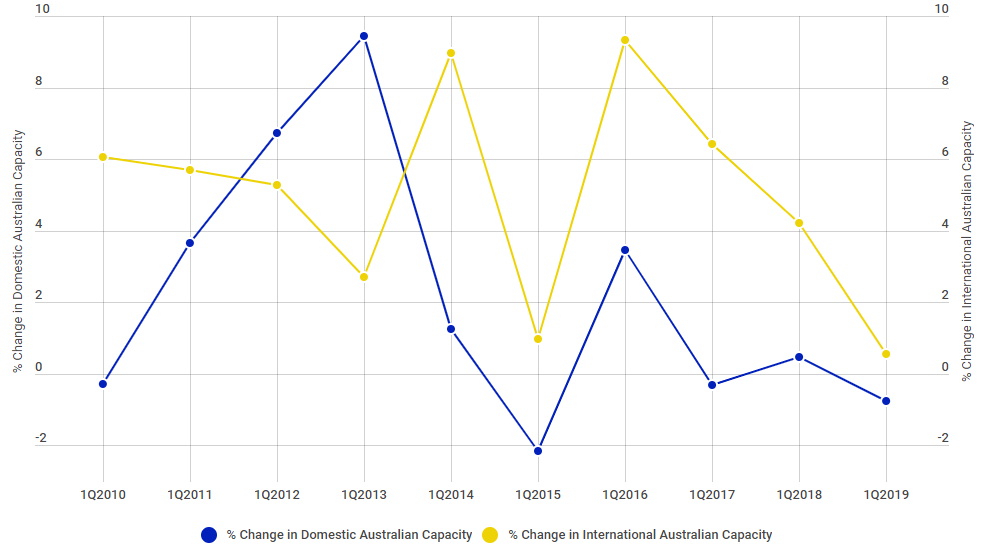

The domestic market retained the positive performance recorded in 2017 (1.5%) following two successive years of declines across 2015 (-0.7%) and 2016 (0.2%), but fell to a quarter of the previous year's level (0.4%). The international market performed more positively with a 3.9% year-on-year growth in 2018, but again this was notably down on the levels seen in previous years, notably 2017 (6.5%) and 2016 (8.0%).

CHART - The 1.8% system capacity growth in Australia in 2018 is fairly solid performance in what is a mature air services market Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

It is no surprise to learn that China was responsible for the largest rise in additional international seats into Australia last year, albeit it remains the fourth largest source market for capacity behind New Zealand, Singapore and United Arab Emirates (UAE). Over 230,000 additional seats were provided between China and Australia in 2018, an 11.2% rise versus 2017. Enhanced air connectivity also helped deliver double-digit rises in capacity offerings from Qatar, Vietnam, Taiwan, Chile, Vanuatu, Sri Lanka, Samoa and Nauru.

Government statistics shows that Chinese arrivals rose 8% to 1.3 million for the 12 months to Sep-2018. Visitors from India increased by 20% to 324,000 during the same period, while there was also good growth in the number of arrivals from Japan, up 6% to 419,000.

But what does the additional capacity mean for Australia? Simply looking at leisure arrivals, the country's minister for trade, tourism and investment, Simon Birmingham, has reported tourists spent AUD113.4 billion (USD81.0 billion) in the country in the year ending Sep- 2018, with more visitors travelling to regional areas of Australia. Domestic visitors spent a record AUD70.3 billion in Australia on tourism during the period, a 10% increase, whilst international visitors made up the remainder, AUD43.2 billion and a 5% rise.

"These latest results show 2.84 million international travellers chose to travel beyond our capital cities and spent time in the bush, at the coast or even in the outback", Minister Birmingham stated.

CHART - Looking at flight schedules through the first quarter of 2019 suggests a quiet start to 2019 for the Australian aviation sector Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

As Australia basks in summer sunshine, schedules for the first three months of the year share a cautionary prognosis for 2019. Based on current published schedules through to the end of Mar-2019, overall capacity from Australia is set to slip by -0.4%. It is the domestic market that is responsible for the decline with capacity levels showing a -0.8% fall against the same period in 2018. The international market is showing growth, but at a negligible 0.5% year-on-year rate for the period.

For the same period in 2018 domestic capacity was up 0.5% and international departure seats up 4.2% to deliver a 1.4% rise. While we are not comparing like for like (a completed three month flight programme versus a proposed schedule), it does provide something to monitor over the coming months.

For now, memories of the Perth - London launch 2018 will probably be more fondly remembered than perhaps its performance merited. But that could quickly slip from the memory in the coming years as Qantas looks to expand its Kangaroo Route offering with new London non-stops from Sydney and Melbourne, as well as links from the Australian cities to New York.

Qantas Group CEO Alan Joyce has said the Perth - London service has demonstrated there is "amazing demand" for non-stop services to Europe and perhaps the platform to hit the next frontier and help the carrier take the prize of operating the world's longest commercial air services from 2022/2023.