Summary:

- Passenger traffic at Athens International Airport has hit a new high with May-2018 levels delivering the highest monthly level since 2008 when the financial crisis hit Greece;

- The strong performance in the capital city and the largest Greek airport has not be replicated across the country, but overall, results are positive;

- The traffic statistics would seem to suggest that the country seems to be coming out of its recession, but there still remains some way to go;

- It is not all plain sailing of course. There will be a Greek general election in 2019 and a new government might have different views on the critical role of aviation.

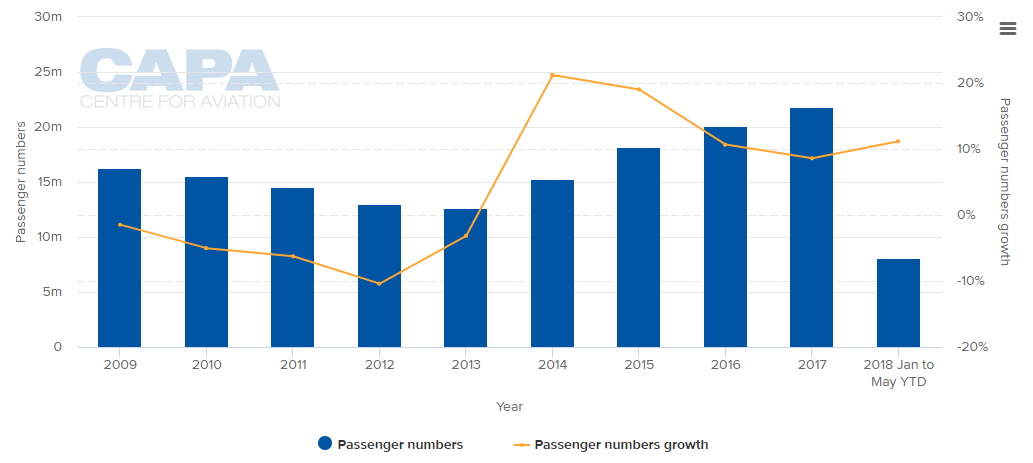

Those figures were the icing on the cake for an airport that has been experiencing consistent growth since 2014, an annus mirabilis in which there was a +21.2% increase and which heralded three further successive years of +19.0%; +10.7% and +8.6% respectively. The strong May-2018 performance brings the increase in the first five months of 2018 into double digits at +11.2%.

CHART - Athens International Airport is showing strong recovery from the traffic declines it had seen through to 2013 with significant year-on-year growth in each of the subsequent years Source: CAPA - Centre for Aviation and Athens International Airport reports

Source: CAPA - Centre for Aviation and Athens International Airport reports

Athens success is not necessarily the norm for other Greek airports thought and where there is a mixed picture of performance. Restricting the analysis to the first three months of 2018 (as few airports have data beyond Mar-2018) several have registered large passenger number increases (e.g. Kavala in East Macedonia, on the coast), some have seen significant falls (e.g. Thessaloniki, the second city, and the island airport of Mykonos), while others have seen big increases followed by big decreases (e.g. Kos).

The in-demand airport of Preveza on the western coast, which also serves the island of Lefkas, seems to be benefiting from its concession to Fraport Greece. It saw a +7.2% increase in Jan-2018, followed by one of +148.8% the following month and then a staggering +645.9% in Mar-2018.

The only consistency in these statistics is the lack of consistency. It is not a simple matter to draw conclusions about the impact of Greece's economic problems over the past decade but in the case of Athens, the capital, where outbound travel is as important as inbound, it may be a little easier.

Between Jul-2017 and Dec-2017 the economic outlook began to improve significantly. By May-2018 newspaper reports were able to claim that Greece was "escaping its financial tragedy" after eight years of recession had left the economy 25% smaller than it was before the twin body blows of the credit crunch and the debt crisis.

This has happened despite Prime Minister Alexis Tsipras rejecting reform packages set out by the European Union and IMF and holding a referendum in which 61% of the population voted against those packages, then having humiliatingly to sign up to the deal anyway, putting his own position in jeopardy.

Mr Tsipras is on the verge of exiting the bailout programmes and has even attracted praise from the Head of the OECD. But economic statistics are positive. Greek GDP is set to grow by +2% this year and by +2.3% next year, which would be more than the euro zone average in 2019. The Athens stock market has almost doubled in two years. Unemployment is still high but has fallen from almost 28% in 2014 to just over 21%.

Exports have increased, partly because the long squeeze on wages has made Greece a more competitive economy. The traditional hotspots of shipping and tourism are rising - inbound visitor numbers rose +17% on the year in 2017. Greece's 10-year borrowing costs are below 4%, less than half the level two years ago and a small fraction of the more than 30% at the height of the crisis in 2011 and 2012. The government returned to debt markets in 2017.

Shares in sectors from healthcare to plastics have jumped, with domestic and export growth boosting different parts of the economy. Manufacturing surveys show growth running at levels not seen since before the crash. It is this diversity of growth that has separated Athens from the regional economies that are more tourism-influenced.

The economic scenario also validates Fraport Greece's gamble of entering into a 40-year concession on 14 Greek airports with its local partner Copelouzos. Continuing growth at Athens will eventually trickle through to the regional ones.

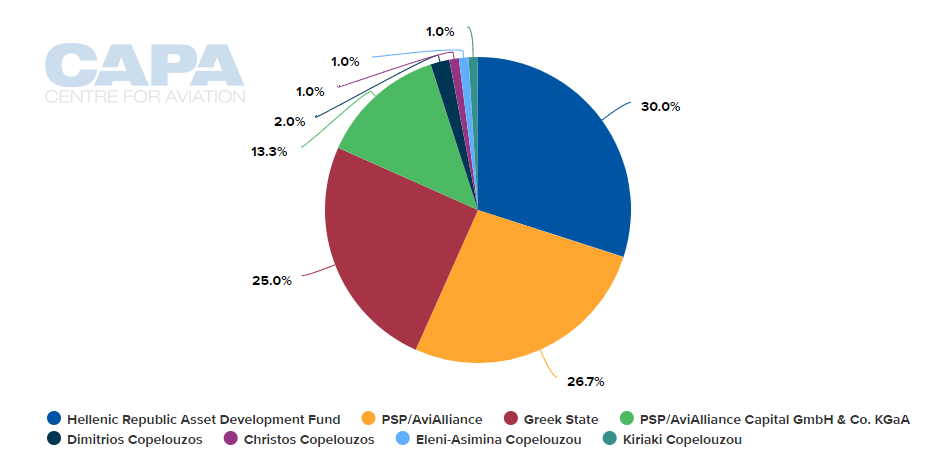

But Fraport does not own Athens International Airport. The major shareholders there are the Republic's Asset Development Fund and the State (jointly 55%), and PSP/Avialliance and their capital fund (40%). That could change in the light of these economic developments. While it has been against further privatisation of this asset the government may decide that now is the time to cash in. And that further privatisation remains a demand of the bailout negotiators.

CHART - The ownership of Athens International Airport is split between a number of parties, albeit the Hellenic Republic Asset Development Fund and the State together hold a majority share Source: CAPA - Centre for Aviation

Source: CAPA - Centre for Aviation

One benefit of the financial crisis is that the airport was able to postpone further modular infrastructure additions that were planned. It opened with a capacity of 16 million ppa which was increased to 26 mppa through the use of technology. With traffic of 21.7 million passengers in 2017 the time is fast approaching for the next phase of what will be six additional projects. The final one, when it comes, will enable the airport to host 50 mppa though there is ample space to add more terminals as required.

It is not all plain sailing of course. There will be a Greek general election in 2019. Another government might have different views on which direction to take. Meanwhile, reducing debt further as a proportion of GDP (ideally to 100% by 2050) is dependent on the adoption of additional OECD proposals which include boosting tax collection. This in a country where the average annual salary has fallen from EUR18,500 in 2010 to just over EUR12,000 now.

Clearly there is still some way to go, which makes the results being achieved at Athens International Airport look all the more impressive.