Summary:

- The first wholly private airport opens in Vietnam;

- Indonesia's state airport operators could be privatised; they are taking on more airports and looking abroad;

- While prevarication hangs over a 'new Manila Airport' the Clark Airport gets a private-sector consortium operator;

- Pakistan looks seriously at privatising its main airports for the first time;

- Japanese companies close to completing new Mongolian airport;

In Vietnam, the Sun Group, a property developer, officially opened Van Dong Quang Ninh International Airport. The VND7.46 billion (USD310 million) facility is Vietnam's first privately funded airport and was developed with assistance from Netherlands Airport Consultants (NACO). Described by NACO as "the most modern airport in Vietnam", Van Don is expected to handle up to 2.5 million passengers per annum in its first two years of operation, and is targeted to achieve five million passengers annually by 2030.

There have been, and will be, other private sector opportunities in Vietnam, which is keen on promoting them, such as the huge USD16.3 billion Long Thanh International Airport, to be located 40km northeast of Ho Chi Minh City Tan Son Nhat Airport, though that particular project is making slow headway. Airports of Vietnam has just announced it is prepared to invest up to USD1 billion in the project.

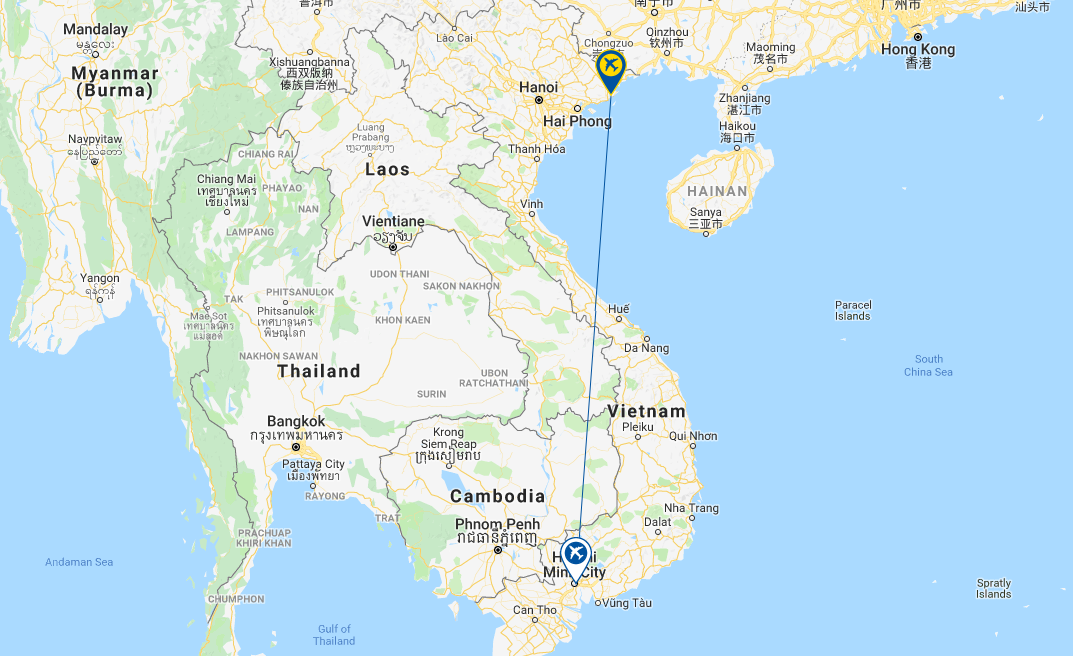

MAP - Quang Ninh International Airport is located on Van Don Island in Vietnam's Quang Ninh Province and is presently only linked to Ho chi Minh City by Vietnam Airlines Source: CAPA - Centre for Aviation and OAG (data: w/c 07-Jan-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 07-Jan-2019)

One of Indonesia's two state airport operators (at least one of which may be privatised in 2019), PT Angkasa Pura I, launched a new corporate vision for 2019, focusing on "going global and network minded" approaches. It did not make clear just what "going global" means. It could refer just to network development or it could mean partnering with investors to operate and develop more Indonesian airports. The New Yogyakarta Airport in Kulon Progo is one of several airports that will open this year. AP I expects to handle more than 101 million passengers in 2019 and to increase revenue by 18%.

Meanwhile, its stable mate, PT Angkasa Pura II, is more external-looking and had already partnered within a Joint Venture with AirAsia and others to tender (unsuccessfully) for the operation of Clark International Airport in The Philippines. Having got the taste for it, we expect that company to seek more in 2019.

MAP - PT Angkasa Pura I has an airport portfolio that spreads across the whole of Indonesia and into international markets Source: CAPA - Centre for Aviation

Source: CAPA - Centre for Aviation

In The Philippines, the successful bidder for the 25-year operations and management contract on Clark International Airport was the North Luzon Airport Consortium (NLAC). NLAC is a grouping of Filinvest Development Corporation, JG Summit Holdings, Inc, Philippine Airport Ground Support Solutions, Inc, and Changi Airport Philippines Pte Ltd, i.e. three Filipino organisations and the Philippines-registered subsidiary of the Singaporean airport company, and led by JG Summit Holdings.

For the three Filipino companies it becomes their first active engagement in airport management. NLAC plans to invest PHP6 billion (USD115 million) in modernising the airport and increasing terminal capacity to eight million passengers per annum.

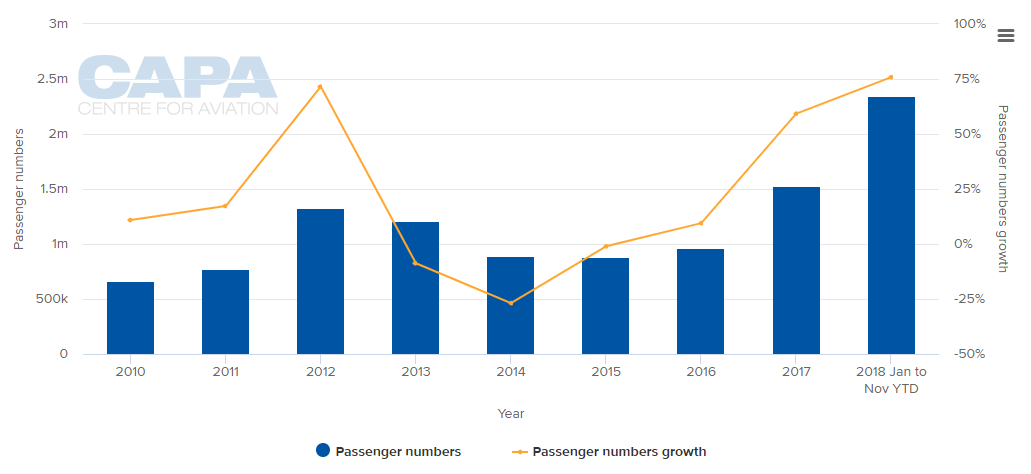

CHART - Passenger growth at Clark International Airport in 2017 was significant at 59% , but 2018 is expected to exceed that with a 76% year-on-year rise across the first 11 months Source: CAPA - Centre for Aviation and Clark International Airport reports

Source: CAPA - Centre for Aviation and Clark International Airport reports

At least a decision has been made in The Philippines. In contrast the proposed new airport for Manila (which is also served by Clark; it is 80 km/50 miles northwest of the capital) is a long-running affair. Late in Dec-2018 the Philippines's National Economic and Development Authority (NEDA) approved negotiated results of the concession agreement between the Philippines Department of Transportation and San Miguel Corporation for the New Manila International Airport project on a 2500-hectare area of land in Bulakan, north of Manila Bay.

The proposal entails a total project cost of PHP735.6 billion (USD13.9 billion). San Miguel Corporation reported the company is targeting a 2019 start date for construction but even now the Philippines' Department of Transportation is aiming to launch and conclude a competitive challenge to the proposal by the end of 1Q2019.

Over in Pakistan, the Civil Aviation Authority, clearly with an eye on the sudden surge of airports earmarked for concession in India, has established a committee to examine the feasibility of privatising the major airports of New Islamabad, Karachi Jinnah and Lahore Allama Iqbal.

New Islamabad International Airport only commenced operations on 03-May-2018 and is the new primary international gateway to Pakistan's capital and the only Pakistani airport capable of handling the A380. The airport replaced the existing Benazir Bhutto International Airport. It is Pakistan's second green field airport and is built 20 km outside the twin cities of Islamabad and Rawalpindi, near the Kashmir Highway. It will handle 15 million ppa in its first phase and ultimately 25 mppa.

Finally, in Mongolia, Prime Minister Ukhnaagiin Khürelsükh reported the government aims to commence operations at the New Ulaanbaatar International Airport by Jul-2019. Construction works to develop a six-lane highway connected to the airport are expected to be completed in Apr-2019.

It is being built to replace Ulaanbaatar's existing Chinggis Khaan International Airport (Ulaanbaatar Buyant Uhaa Airport). Japan's Mitsubishi Corporation and Chiyoda Corporation are building it at an estimated cost of USD500 million and it is located approximately 50 km southwest of the capital.