Summary:

- The fourth tranche of airport concessions in Brazil has received ANAC approval for 12 facilities across the country, separated into three groups;

- Each has an 'anchor' airport of sorts but with one exception those airports are getting smaller and less appealing;

- The question now is what priority (if any) will the very small ones be given by the concessionaires?

Others have previously included São Paulo Guarulhos, Brasilia and Campinas Viracopos airports (Tranche #1); Rio de Janeiro Galeão and Belo Horizonte Tancredo Neves airports (Tranche #2); and Porto Alegre and Salvador airports (Tranche #3).

It is has not been an entirely satisfactory procedure with some well-above-expectations deals contrasting with disappointing traffic statistics as Brazil's economy turned for the worse. The economy is slightly improved but it is a long time since Brazil was the "star B in the BRICs".

A change of government may see the new Bolsonaro one, together with its Economy Minister, Paulo Guedes, a student both of Milton Friedman and the 'Chicago Boys' who revitalised the Chilean economy, turn to the free market reforms that succeeded in doing that in Brazil's neighbour.

None of this has actually diverted interest in these concessions from domestic and international investors alike. Airport investors, unlike airline ones, are in it for the long-term. It is known that at least four of them would like to take over the Campinas Viracopos concession, including Flughafen Zurich, Brazilian private equity turnaround specialist IG4 Capital, and Chinese conglomerate Alibaba, as previously highlighted by The Blue Swan Daily.

https://corporatetravelcommunity.com/chinas-alibaba-looks-to-invest-in-brazilian-airport-for-its-new-south-america-logistics-hub-but-it-could-face-some-heavyweight-competition/

Indeed, Flughafen Zurich, which has been investing in Latin America since before Brazil became the highflying BRIC, has indicated it would like to bid on all three of the blocks in the forthcoming tranche. In a way that is surprising because the process is now down to much smaller airports than before, the bone in the Brazilian expression 'steak with bone'. So is there any steak in there? Are there, as in the Mexican concessions procedure, any 'anchor' airports?

There do appear to be what might be described as anchor airports, with between 2.9 million and 6.8 million passengers in 2017. They are Recife Guararapes (Northeast Group); Cuiaba Marechal Rondon (Central/West Group) and Vitoria Eurico Sales (Southeast Group). Their growth performance in 2017 was varied at between +4% and -3%, but that is not dramatic. The groups also include airports with traffic as low as 0.5 mppa in the Northeast Group and 0.18 mppa in the Southeast Group (statistics are patchy for the Central/West Group).

While airports offer alternative business development opportunities such as cargo, trading and logistics parks (even 'airport cities'), maintenance, storage/breakage and a myriad of other aero and non-aero uses, an investor will usually look at the size of the passenger market first and whether there is a reasonable prospect of it being extended.

Taking the largest and most promising in this respect, Recife's Guararapes airport, Recife is the fourth-largest urban agglomeration in Brazil, with four million inhabitants. That makes it a better 'bet' than Florianópolis (1.1 million) where Flughafen Zurich took on the concession in 2017. It is also on the coast and along with Fortaleza and Salvador, which were concessioned to Fraport and Vinci respectively in the third tranche, and Natal, which featured in the first tranche, the nearest air entry point to Europe and Africa.

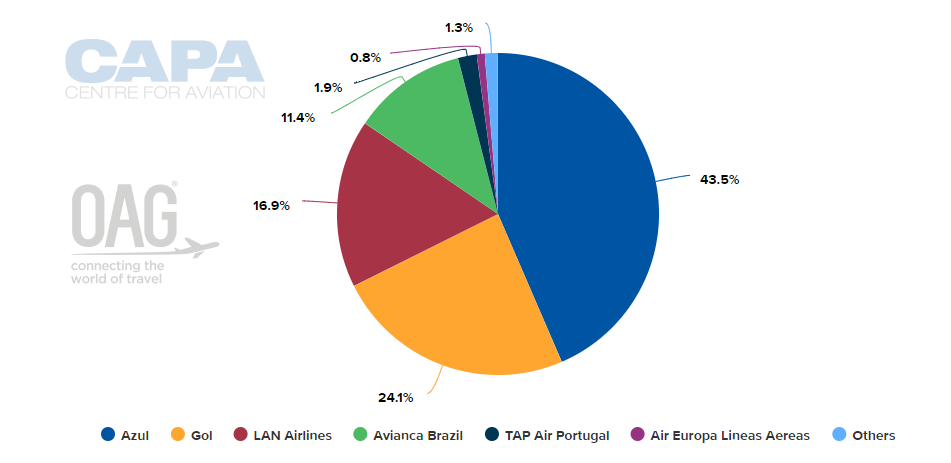

International services already exist at Recife, amounting to a modest 6.3% of capacity but foreign non-Latin American carriers have made little impact with TAP Air Portugal and Air Europa amounting to only 2.7% of capacity between them. So there clearly is plenty of scope at Recife and has to be described far and away as the star prize in this set of deals.

CHART - Azul Airlines is the largest operator at Recife Guararapes International Airport where local Brazilian operators account for more than 97% of the weekly seat capacity Source: CAPA - Centre for Aviation and OAG (data: w/c 26-Nov-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 26-Nov-2018)

There is always a risk in this sort of bundled contract scenario, unless it is written otherwise in stone, that smaller airports may be overlooked and that profits emanating from the larger ones will not find their way to supporting them. That is one of the reasons why Spain's AENA was privatised in the way it was, with all assets kept together and the government retaining the majority share in all the airports, rather than in smaller packages anchored to, say, Madrid, Barcelona and Palma airports.

The future for those smaller airports might come to be dependent not so much on the introduction of a free market economy but on structured regional economic support and there is therefore an argument that they might have been better left with what remains of state operator Infraero, with only the biggest of each group actually being privatised, or perhaps even only Recife.