In many ways, LCCs are no different from full service airlines in this respect. The LCC business model is now well established throughout the world and low cost operators are among some of the biggest airlines globally.

Nevertheless, it is still regarded to some extent as a newer model, and financiers will typically take a more rigorous approach when considering the provision of funds to start-up and younger airlines. Even where the model is not really very new, low cost operators often pursue higher growth rates, and this can also be a source of additional risk.

Perhaps because many low cost airlines typically have shorter track records and are less well capitalised, the share of the world LCC fleet that is leased is higher than for the total fleet of all airlines. In particular, LCCs make significant use of sale and leasebacks.

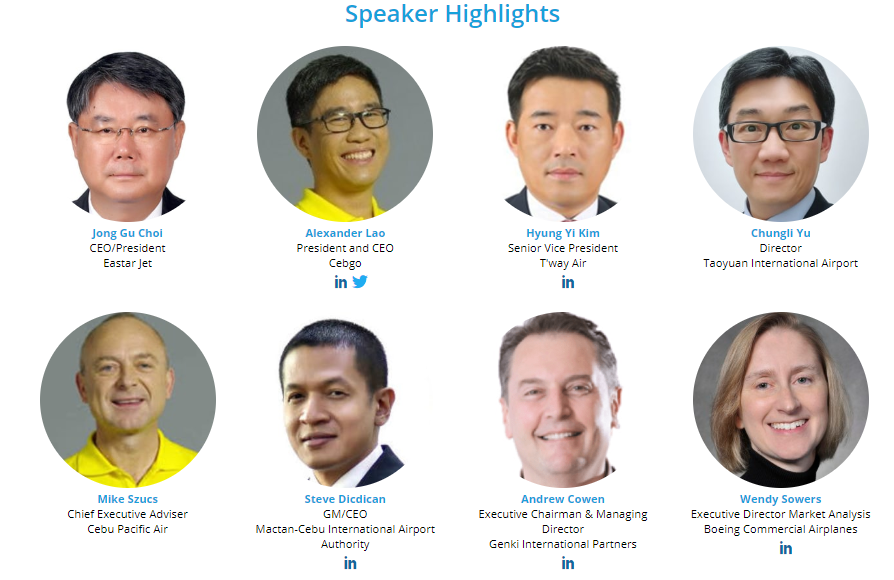

As one the discussion topics at the forthcoming LCCs in North Asia Summit, CAPA - Centre for Aviation will explore in detail the air finance industry from a LCC perspective and highlight the positive and negatives of current business strategies.

As the foremost authority on aviation in the world, CAPA - Centre for Aviation's events provide cutting edge knowledge about strategic market trends and dynamics to help attendees make informed decisions, delivering the information and connections needed to inspire and improve business. The LCCs in North Asia Summit will take place in Cebu between 24-25 June 2019.

LCCs have been rarely out of the news over the past 20 years as they disrupted market after market. And ever since, full service airlines have been learning from the often revolutionary methodology applied by the LCC model, in such areas as ancillary revenue as well as operational efficiencies and cost reduction. Equally, as LCCs proliferated and entered new markets, many sought to diversify, creating systems that mimicked their older peers.

The two service groups have converged to a point where full service carriers are launching LCC subsidiaries or attempting to buy independent LCCs as a means of targeting both full service and lower priced segments more effectively. Until relatively recently, dual brand strategies targeting different market segments have been rare. But the industry is now rife with such examples, notably in Asia Pacific. This combination of full service and low cost/no frills airline within one group has become a powerful combination to combat independent LCCs making inroads into the traditional leisure sector.

Of course, this has not stopped independent LCC groups from encroaching on their full service rivals. In Europe for example, LCCs have taken advantage of open skies to expand outside their home markets. Ryanair and easyJet are the region's two largest individual airlines by passenger numbers. In other markets like Asia, where the regulatory regime is more restrictive, larger LCCs have circumvented ownership and control provisions by forming cross border JVs with local partners.

All the while there have been changes wrought by the acceleration of technological advances. New widebody and narrowbody aircraft such as the 787s and A350s, and progressively the 737MAXs and A320neos, are opening up new long distance city pairs and justifying the business case for low cost long haul operations. This is encouraging both independent LCCs and full service carriers to establish long haul arms.

The CAPA LCCs in North Asia Summit seeks to tap into the dynamic changes taking place in the airline industry and address the issues in creative and authoritative ways. This event, hosted at the Radisson Blu Cebu, in the heart of Cebu City, is a forum for debate and discussion of this strategic issue within the aviation industry and it is attracting delegate interest from across the globe. It is a must attend for those seeking to do business with and gain inspiration from LCCs, airports, travel technology providers, OEMs and financiers.

FIND OUT MORE… visit the LCCs in North Asia 2019 homepage to find out more about this not-to-be-missed opportunity to discuss relevant issues impacting the aviation sector and learn meaningful insights from your industry peers.