Pricing pressure within California and on transcontinental routes from the state was one of the drivers of Alaska's 6.1% drop in consolidated unit revenue year-on-year in 3Q2017. Yields, which are a direct reflection of pricing, dropped 4.1%

Putting the discounting in context, Alaska executives explained business fares on transcontinental routes from California with zero to seven days advance purchase were lower by 20% to 35% in the quarter, even with healthy demand, and in some cases, flat capacity growth.

Alaska has stated industry capacity from Boston to Los Angeles has reduced marginally, but the cost of a seven day advance purchase fare has fallen approximately 56%, from USD239 to USD104.

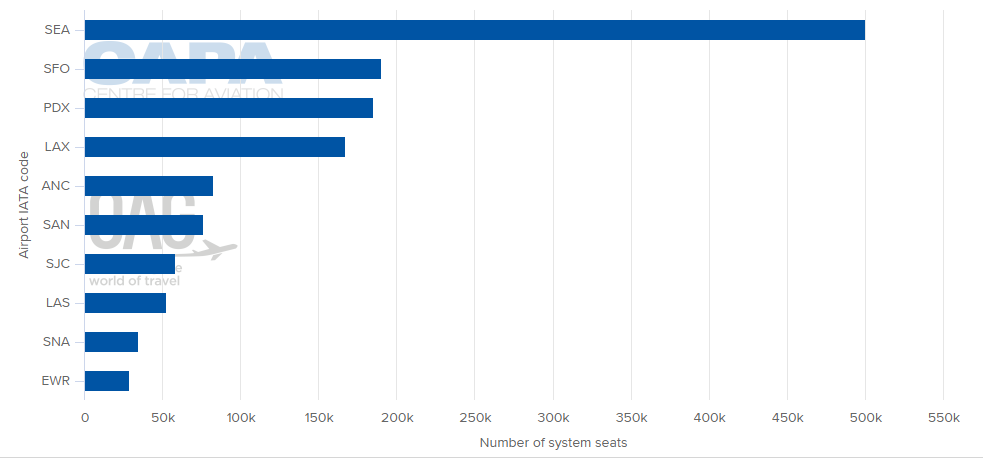

CHART - Alaska Air Group has broadened its reach in California following its acquisition and merger with Virgin America as its biggest markets for the week commencing 30-Oct-2017 illustrates Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

On routes within California, close-in fares are lower by 25% to 35%, according to Alaska. The airline has calculated advance fares in the busy Los Angeles to San Francisco market were actually lower by 38%.

"We're doing our best to get through this, but we do not see any changes in this pricing environment as its stands today", said company chief commercial officer Andrew Harrison.

He explained that at present the revenue environment for 4Q2017 is better than Alaska's performance for Sep-2017, when unit revenue fell 5.7% year-on-year.

The heavy discounting is occurring against a backdrop of demand that is still robust, and benign competitive capacity growth. Previously, Alaska had estimated just 2% competitive capacity growth year-on-year in its network during 3Q2017.

Alaska has less exposure to ultra low cost airlines than other larger US network airlines. US ULCCs Spirit and Frontier represent just 1.7% of domestic seats deployed from Alaska's largest hub Seattle for the week of 30-Oct-2017. Alaska's share is 53.2%.

In the more fragmented Los Angeles market, Spirit and Frontier represent roughly 6% of domestic seats at Los Angeles International, and Alaska and Virgin America account for 11%.

In San Francisco, Alaska and Virgin America combined maintain a seat share of 28%, second behind United at 48%. Spirit serves the Bay Area from Oakland while Frontier operates service from San Francisco.

Broadening its reach in California was the main driver of Alaska's acquisition of and merger with Virgin America. Alaska has calculated its "custom utility," which is the percentage of total demand in geography were it offers a nonstop flight to meet that demand, will reach 70% from San Francisco by YE2017. It is an 11 point increase driven by its purchase of Virgin America.

Across the state of California, Alaska's utility will reach 44% by year-end, which is a 28 point increase from its position prior to the merger. But California's largest airlines, notably United and Southwest, are not sitting idly by while Alaska builds its arsenal in the state. Clearly those two airlines are willing to endure some short term pricing pain to show Alaska they have no intentions of losing share in the market.