Topping the world's largest passenger airport by traffic and movements tables for many years thanks to the significant domestic feed that supports the Delta Air Lines' hub activities, Atlanta's Hartsfield-Jackson International Airport continues to expand. But, it is increasingly looking back as major gateways across Europe, the Middle East and Asia (particularly China), close the gap due to their faster rates of growth. Now handling over 100 million passengers per annum (more than many major city multiple airport systems), the facility is one of the most efficient operations across the globe, recently being ranked among the top three global mega hubs for its on-time performance by intelligence specialist OAG.

In many ways Atlanta's Hartsfield-Jackson International Airport dominates the aviation scene in the southeastern part of the United States in terms of its sheer domestic size and scope, an increasingly important role in international transportation, and as a competitor to well-established cargo hubs.

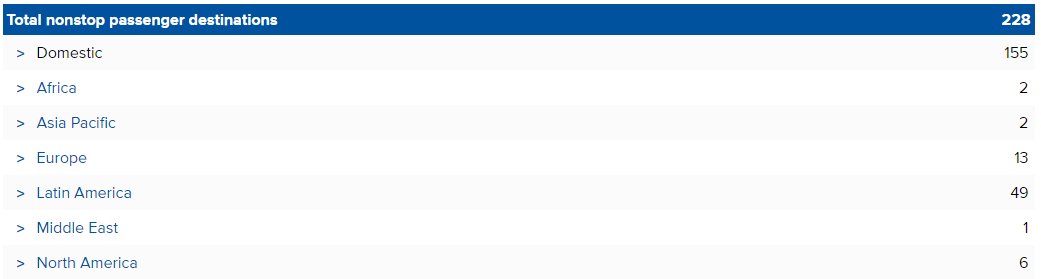

NETWORK: According to flight schedules from OAG for the week commencing 08-Jan-2018, Hartsfield-Jackson International Airport is directly linked to 228 destinations, more than two thirds of which (155 destinations; 68.0%) are within the United States, the highest density. Its international activities are dominated by the Latin American and Caribbean region where it is directly linked to 49 destinations across 28 countries, with a fifth of that network in Mexico. A further seven markets across Bermuda, Bonaire Canada, Puerto Rico and the US Virgin islands add to its Americas network, while in the long haul market Atlanta has non-stop links to Africa (Johannesburg and Lagos), the Middle East (Doha), Asia Pacific (Seoul and Tokyo) and 12 destinations across Europe (Amsterdam, Brussels, Dusseldorf, Frankfurt, Istanbul, London, Madrid, Manchester, Munich, Paris, Rome and Stuttgart).

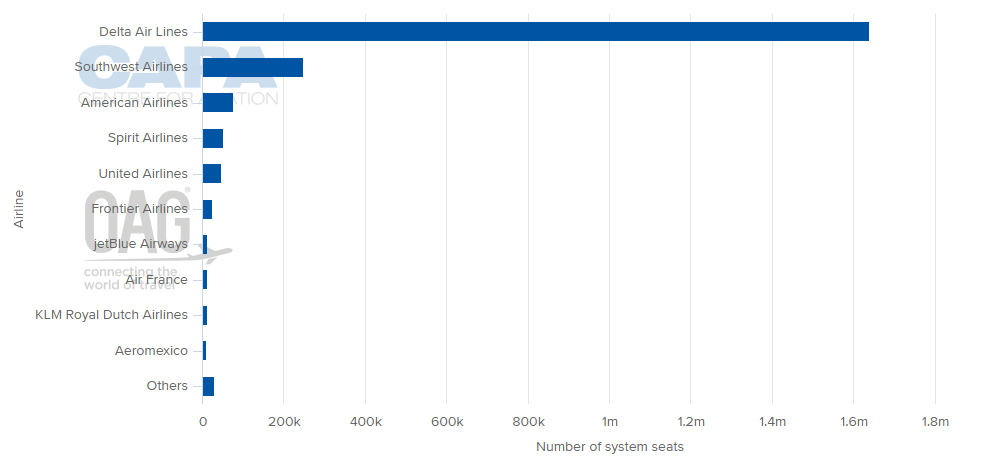

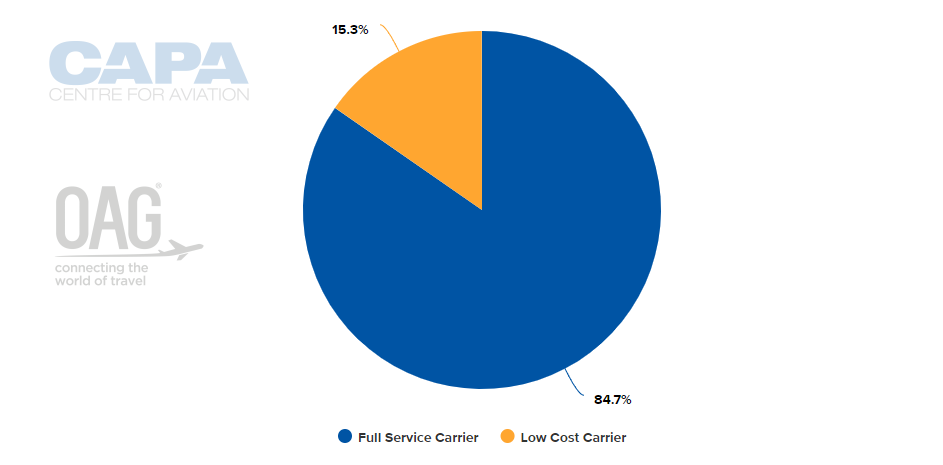

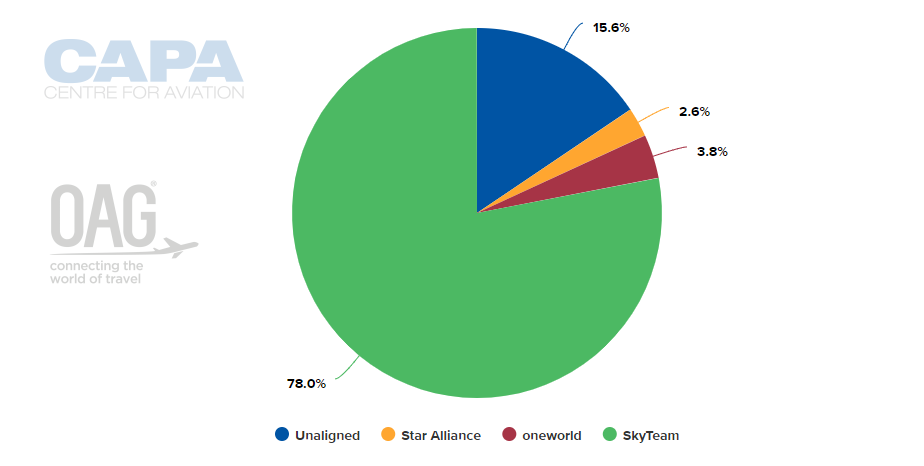

AIRLINES: Delta Air Lines dominates in Atlanta and has a 76.6% share of system seats and 76.8% share of aircraft movements at Hartsfield-Jackson International during the week long analysis period. Its hub operation efficiently feeds the traffic through the airport with transfer traffic the reason the city, relatively small by US standards, can sustain such a large air transport operation. In fact, just 27 airlines currently serve the airport with limited coverage from international airlines. Delta has a 79.3% of international seats and 76.2% share of domestic seats during the analysis period with Air France (3.5% share) and Southwest Airlines (13.0% share) its closest rival in each market, respectively. The dominance of Delta at Hartsfield-Jackson International means LCC penetration is limited to 15.3% of system seats and just 1.8% in the international market. The competitive threat from Delta explains the reluctance of airlines (particularly foreign air carriers) from serving the airport, with most of the non-Delta capacity being provided by SkyTeam alliance partners, clear in its 78.0% share of capacity.

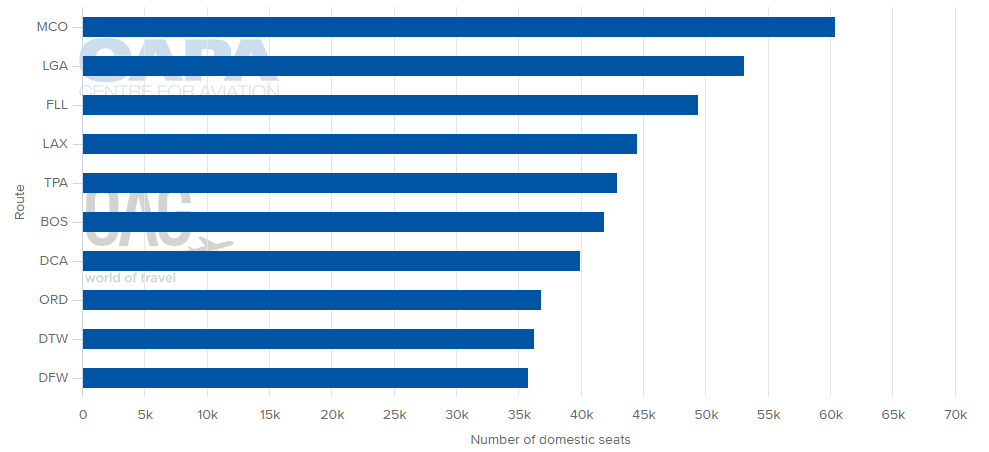

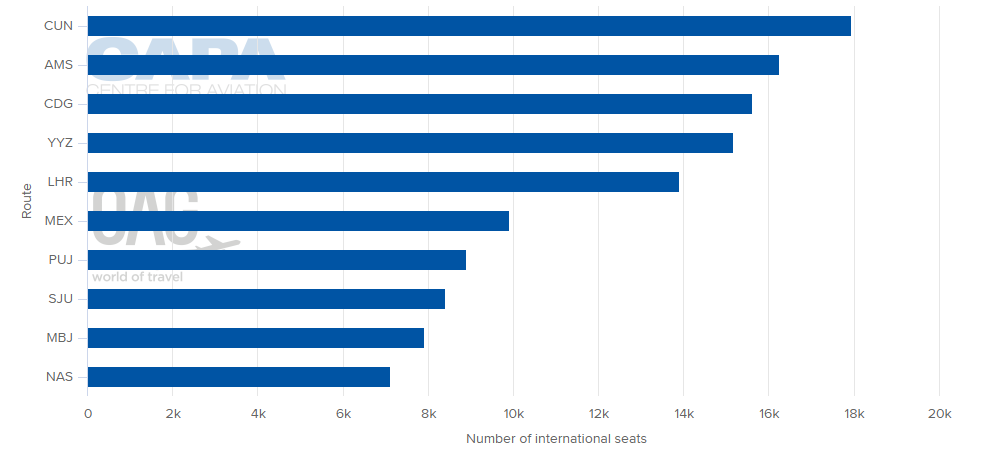

DESTINATIONS: The largest market from Atlanta Hartsfield-Jackson International by capacity this week is to Orlando International Airport in Florida. The US state accounts for three of top five markets by capacity with Fort Lauderdale Hollywood International and Tampa International ranked third and fifth: the popular leisure markets this time of year are separated by the big city markets of New York (via its main domestic gateway at LaGuardia International) and Los Angeles. The largest international market by capacity is Cancun, in Mexico, ahead of the transatlantic hubs of Delta's SkyTeam partner Air France-KLM at Amsterdam Schiphol and Paris Charles de Gaulle airports. When considering international markets by flight frequencies rather than seats then closer markets such as Toronto's Lester B Pearson International and Mexico City's Aeropuerto Internacional Benito Juárez appear more favourably in the analysis.

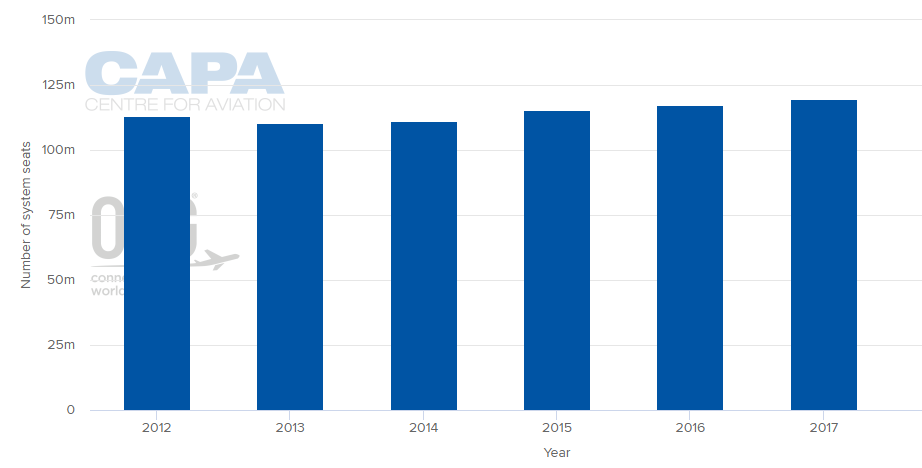

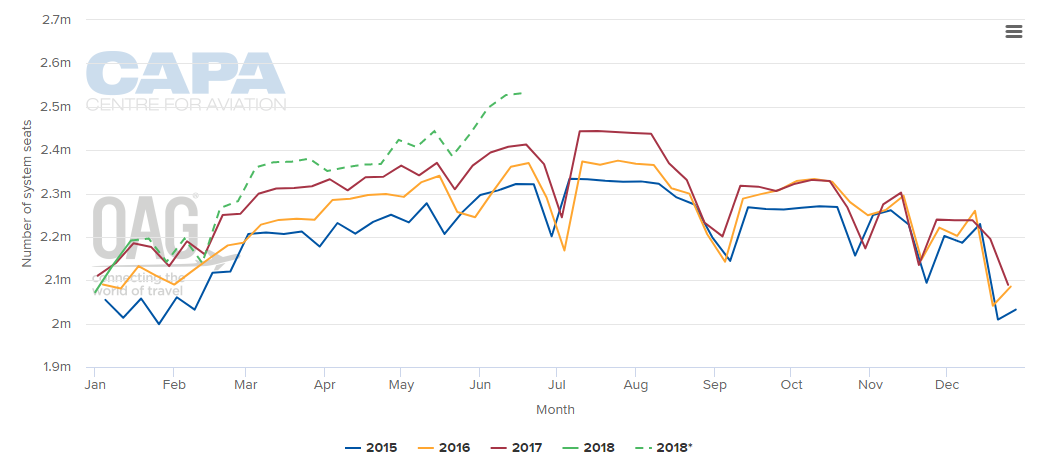

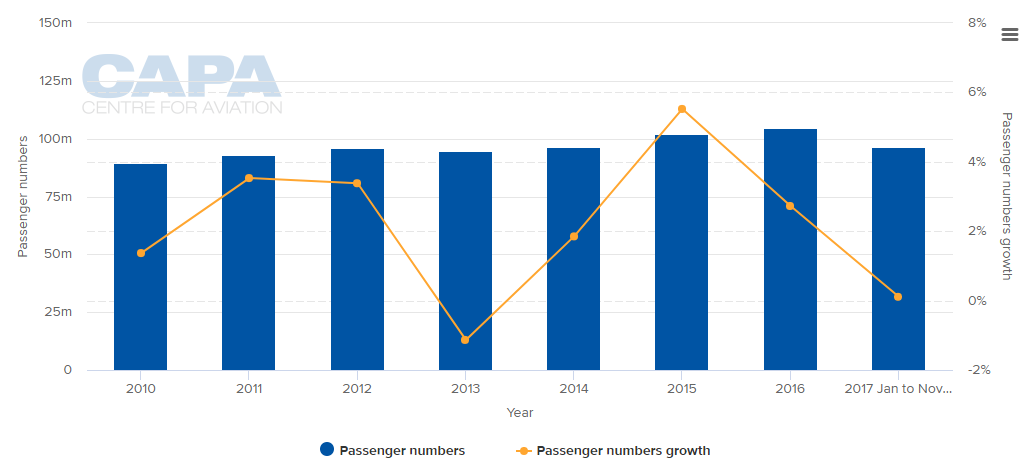

CAPACITY: Total system capacity at Hartsfield-Jackson International Airport rose +1.9% in 2017, slightly higher than the level recorded in 2016 (+1.7%) and up on the five year average. This may seem a slow rate of growth, but given the airport's size it still equates to more than two million annual passengers. Domestic capacity rose +1.8% in 2017, down from +1.9% growth in 2016, while international capacity increased +2.8%, double the rate recorded in 2016. This modest growth is expected to continue through 2018 with advanced schedules for the coming six months showing capacity tracking in line with last year during the first quarter, but then growing from the start of the summer schedules at the end of Mar-2018. This will deliver an expected +1.5% growth over the first half of the year.

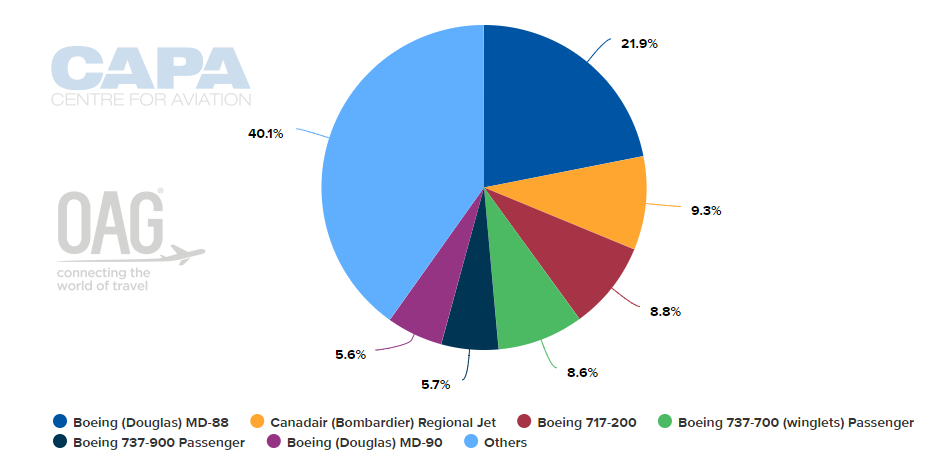

AIRCRAFT: In the modern age where mainline fleets have become dominated by Airbus and Boeing models, Hartsfield-Jackson International is one of the few major airports across the world where operations are still dominated by the venerable McDonnell Douglas family of rear-engined airliners. More than one in five movements (21.9% share) are flown by the MD-88, the the last variant of the MD-80, which was launched in Jan-1986 on the back of orders and options from Delta Air Lines. Its successors, the MD-90 (5.6% share), with modernised engines and longer fuselage, and the Boeing 717-200 (8.8% share), are also among the top six utilised airliners at the airport. The Bombardier CRJ family of regional jets has the second largest share of movements (9.3%), highlighting the key role Delta's regional partners play in feeding the Atlanta hub under its Delta Connection brand.

TRAFFIC: It appears that 2017 will be the first year in a while that traffic levels at Hartsfield-Jackson International have not exceeded capacity growth. After notable growth in passenger numbers of 5.5% in 2015 (versus 3.6% capacity growth) and 2.7% in 2016 (versus 1.8% capacity growth), levels only increased 0.1% across the first eleven months of 2017 (versus a 1.9% capacity growth). Over that period traffic levels were up by just 104,000 passengers versus the same period last year with domestic numbers down -0.5% and international traffic up +5.4% during the period.

OBSERVATIONS: According to the CAPA Airport Construction Database, Hartsfield-Jackson International is in the process of implementing a USD10 billion investment in infrastructure through to 2025, which will provide a passenger capacity of 121 million ppa. The projects include a new (sixth) runway, a car park expansion, terminal enhancements, an airport hotel, and an airport city development. An additional 20-year modernisation and expansion project has also now come into play. A recent CAPA report described the city-owned facility as "a prized possession locally" that "belies the city's relatively low ranking on the global economic scale". Atlanta's economy is diverse, with dominant sectors that include logistics, professional and business services, media operations, and information technology, but it is rated a 'Beta +' world city according to the Globalisation and World Cities (GaWC) Research Network. This ranks it alongside cities such as Auckland, Bangalore, Dallas, Houston and Munich, exerting a 'medium impact' on commerce, finance, research, technology, education, media, art, and entertainment. As the CAPA report identifies: "The size of its airport does not exactly reflect 'medium impact'."

VISIT CAPA - Centre for Aviation to find out how you can access all this information and discover more about the benefits of a CAPA Membership.