Ancillary revenue is generated by activities and services that yield revenue for airlines beyond the simple transportation of customers from A to B. This wide range of activities includes commissions gained from hotel bookings, the sale of frequent flyer miles to partners, and increasingly in the modern age the provision of a la carte services − providing more options for consumers and more profit for airlines.

The IdeaWorksCompany insight for CarTrawler shows that a la carte revenue from optional services, such as onboard sales of food and beverages, checked baggage, premium seat assignments, and Wifi access grew by more than a quarter (26.9%) in 2017 from USD44.9 billion the previous year. Of these, the revenue from checked baggage looms large with USD23.6 billion in estimated sales for 2017.

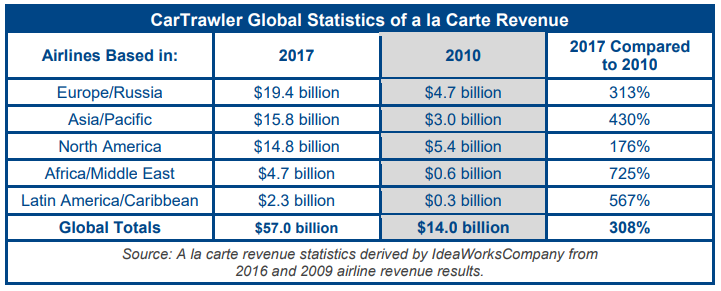

A huge increase of 308% for a la carte revenue since 2010 offers testimony to the growing popularity of the low cost airline model and the a la carte approach to pricing. And of the transitioning of full service carriers to a revised business model that delivers new revenue streams.

"Be it global network airlines like Emirates in the Middle East, ancillary revenue champions such as AirAsia and Ryanair, and even traditional airlines like TAP Air Portugal, all are becoming better retailers," says Aileen McCormack, chief commercial officer, CarTrawler.

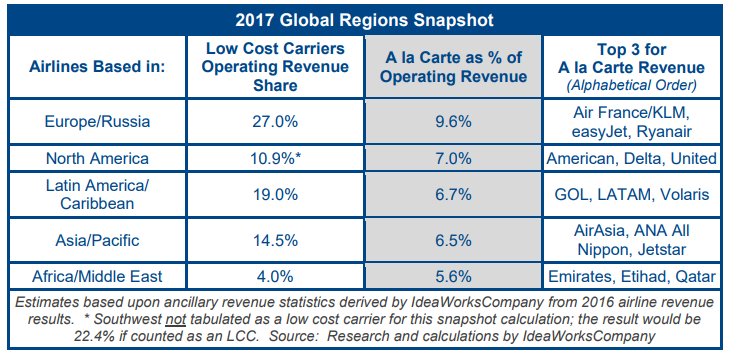

A new regional breakdown of the results highlights how the prevalence of low cost carriers (LCCs) in a region actually drives the level of ancillary revenue. In simple terms a higher concentration of LCCs boosts ancillary revenue and a la carte results and is the reason that Europe is leading the geographical breakdown.

Europe lead for a la carte activity is driven by LCCs generating an impressive 27% of operating revenue for airlines based in Europe and Russia, reveals the report. It's no surprise the region is also top for a la carte revenue as a percentage of overall airline revenue with easyJet, Norwegian, and Ryanair the champions of the development in the region.

The data also highlights that North America has lower LCC penetration, especially with Southwest operating more like a traditional airline in terms of a la carte services. But here, it's major airlines such as Air Canada, Delta Air Lines, and United Airlines have embraced a la carte methods with the three US majors dominating for a la carte revenues.

Within Latin America, the market is rapidly changing with airlines such as GOL, JetSmart, and Volaris challenging the status quo of all-inclusive airline pricing. Regulations are also changing; during 2017 Brazil allowed airlines to charge fees for checked bags on domestic flights. This has helped boost a la carte revenue share to 7.0% and is likely to grow higher in 2018 as market changes continue and the LCC model expands across the region.

The Asia/Pacific region has a long LCC tradition with the vast network reach of AirAsia Group leading the way. However, the data highlights that the region's global network and traditional airlines have been far slower to adopt the a la carte methods now seen in the developed Europe and North American markets. However, with the low cost model on the verge of take-off in China, the region could quickly see significant changes in future reports.

Africa and the Middle East lag in low cost carrier and ancillary revenue development. The top a la carte revenue producing airlines are rated as such because of their large size, and not for aggressive retail activities, notes the report The region's significant low cost carriers are limited to Air Arabia and flydubai - both of which have developed a more hybrid model approach - but still post annual ancillary revenues in excess of USD300 million.

IdeaWorksCompany notes that within each region of the world the transformation has been strikingly similar - dominated first by LCCs and then a trend towards traditional airlines as they are compelled to match the pricing strategies of their LCC competitors. "This begins within the region on shorter routes, and in the most developed regions, also becomes a factor for long-haul flights," it says.

In the longer term the company predicts the global figures will eventually match the results that are being produced by Europe with an operating revenue share in excess of 25% and a la carte activity around 10% of overall revenue. This prediction it describes as a "big thing" for consumers by allowing more travellers in developing markets to be able to enjoy a basic fare product and select individual frills from an a la carte menu. But it warns that while business models are changing, "only the most skilled of airline retailers will flourish" in this rapidly evolving environment.