The biggest driver of demand will be the Asia-Pacific region. The region will be the source of more than half the new passengers over the next two decades. IATA predicts that China will displace the United States as the world's largest aviation market around 2022, two years earlier than in its 2016 forecast.

The UK will fall to fifth place, surpassed by India in 2025, and Indonesia in 2030. Thailand and Turkey will enter the top ten largest markets, while France and Italy will fall in the rankings to 11th and 12th respectively.

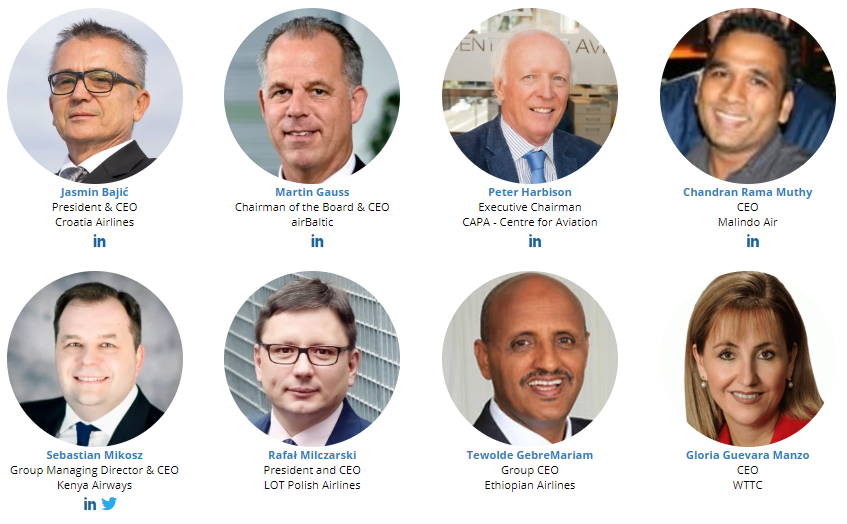

A strategic look at the world's aviation markets, hot and otherwise will be discussed at the forthcoming high-level CAPA- Centre for Aviation Airline CEOs in Sydney gathering. The forum takes place in Sydney, Australia on 05-Jun-2018 and 06-Jun-2018 immediately following the conclusion of the International Air Transport Association (IATA) General Assembly in the same location.

Markets to be studied comprise...

China - no-one doubts the long term size of the China market, as its economy grows and as the tourism bug bites its residents. It has already transformed the tourism profile of many countries in the region. But for airlines the challenge of matching demand with supply and at reasonable rates is a major challenge. This applies to Chinese and foreign airlines alike. Resolving those issues is critical for many tourism bodies and airports who are refocusing their efforts towards accommodating a sudden wind change in inbound tourism and new business flows - as it is for investors and infrastructure providers.

India - protectionist policies and unpredictable regulation have imposed a major handicap on the development of aviation and tourism - along with the necessary infrastructure - in India. Today however there is a new sense of hope, as India's economy surges and its aviation regulatory structure is adapted to new needs. There is still much to be done, but things are changing fast. New airlines and old are feeling the wind under their wings and the industry is moving towards profitability.

Southeast Asia - roughly 50% of the seats flying in Southeast Asia are on low cost airlines. Some of these are subsidiaries of full service airlines. The region is also a breeding ground for long haul low cost airlines. LCCs, long and short haul have well over 1,000 aircraft on order. This calls for innovative strategies from incumbent full service airlines. It also creates conditions for a future evolution that could be dramatically different from other parts of the world.

The Americas - as US airlines enjoy an unprecedented period of profitability at home, they are spreading their wings into international markets. A strengthening economy is supporting that expansion, although there are concerns that a gathering nationalism might endanger previous trends towards more open markets, with it dampening traffic growth. Latin America's airlines meanwhile are gaining confidence as they consolidate and move into a more genial economic climate. In all cases, partnerships are playing an important role, especially over the long distances of the Pacific.

North Asia - Despite recently being in the shadow of China's rapid expansion, there is much activity in other North Asian countries. Japan in particular has undergone a transformation in inbound tourism, as well as its traditional sources of higher yielding outbound traffic. Here LCCs are increasingly active, notably as subsidiaries of the major airlines. But South Korea and Taiwan as well are enjoying healthy growth. To the west, Kazahkstan and the other "Stans" are also becoming aviation forces in their own right.

Europe, the Middle East and the UK - the impact of Brexit and on EU horizontal open skies agreements (including Australia/ASEAN), as well as intra-EU, and for the North Atlantic Open Skies multilateral is a great unknown and could have global ramifications for the airline industry. Multilateral negotiations are also in progress between the EU and the Gulf states. A big question in that respect is the impact on EU policy as the UK - one of the most liberal voices - leaves the Union. One thing is certain: there will be a period of uncertainty, of uncertain length. For airlines and travel markets, the key is finding work-arounds while this lack of clarity persists.

Understanding aviation markets is CAPA's great strength and passion and this event's agenda includes a variety of topics sure to generate interest. A strategic look at the world's aviation markets, hot and otherwise will be the day's agenda at the Sydney forum on 06-Jun-2018.

It's hardly a secret that the airline industry is facing myriad challenges, notably in the marketing and distribution areas, as companies with personalised data, and the analytics and artificial intelligence to go with it, become greater threats to the stability of the traditional airline model.

This high-level aviation event, hosted at Sofitel Sydney Darling Harbour is a must attend for those seeking new ideas and business opportunities with aviation leaders across the globe and to hear from and gain unfettered access to CEOs of the world's leading airlines.

FIND OUT MORE… visit the Airline CEOs in Sydney homepage to find out more about this not-to-be-missed opportunity to discuss relevant issues impacting the aviation sector and learn meaningful insights from industry leaders.