Summary:

- Airbus and Boeing have revised their global aircraft delivery forecasts upwards compared to the last editions released last summer;

- Airbus predicts the commercial aviation sector will grow at an average rate of +4.4% per year over the next 20 years, driving a need for 37,390 new passenger and freighter aircraft;

- Boeing's forecast of 42,730 new jets over the next 20 years is valued at USD6.3 trillion and represents a +4.1% in total aircraft numbers over last year's report;

- Airbus and Boeing both agree that Asia Pacific will dominate the future delivery schedule and account for two in every five aircraft deliveries over the next 20 years.

Airbus predicts the commercial aviation sector will grow at an average rate of +4.4% per year over the next 20 years, driving a need for 37,390 new passenger and freighter aircraft. Its latest Global Market Forecast for the 2018-2037 period says growth drivers include private consumption increasing 2.4 times in emerging economies, higher disposable incomes and a near doubling of the middle classes globally.

It predicts emerging countries will account for over 60% of economic growth, with trips per capita to multiply 2.5 times for these nations. Combined with evolving airline business models and continuing liberalisation, the growing scale of air transportation "will lead to an increasing resilience to regional slowdowns," says Airbus, while greater aircraft range and capacity through technological developments will allow airlines the flexibility "to explore new business opportunities whilst maintaining focus on cost reduction".

In its small segment, covering the space where most of today's single-aisle aircraft compete, there is a forecast future requirement for 28,550 new aircraft, representing more than three-quarters of total expected demand. In the Medium segment, for missions requiring additional capacity and range flexibility, represented by smaller widebodies and longer-range single-aisle aircraft, Airbus forecasts demand for 5,480 passenger and freight aircraft.

For additional capacity and range flexibility, in the Large segment where most of its A350s are present today, Airbus foresees a need for 1,760 aircraft, while in the Extra-Large segment, typically reflecting high capacity and long range missions by the largest aircraft types including its A350-1000 and the A380, Airbus forecasts demand for 1,590 aircraft over the next 20 years. Of the 37,390 new aircraft required, 26,540 are for growth and 10,850 will replace older generation less fuel efficient aircraft.

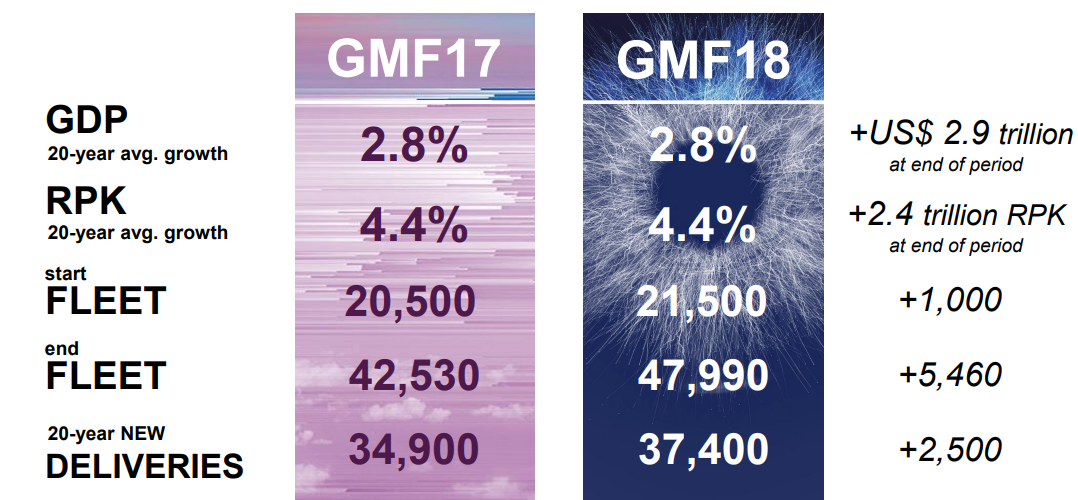

CHART - The latest forecast from Airbus anticipates an additional 2,500 new aircraft deliveries over the next 20 years Source: Global Market Forecast 2018-2037.

Source: Global Market Forecast 2018-2037.

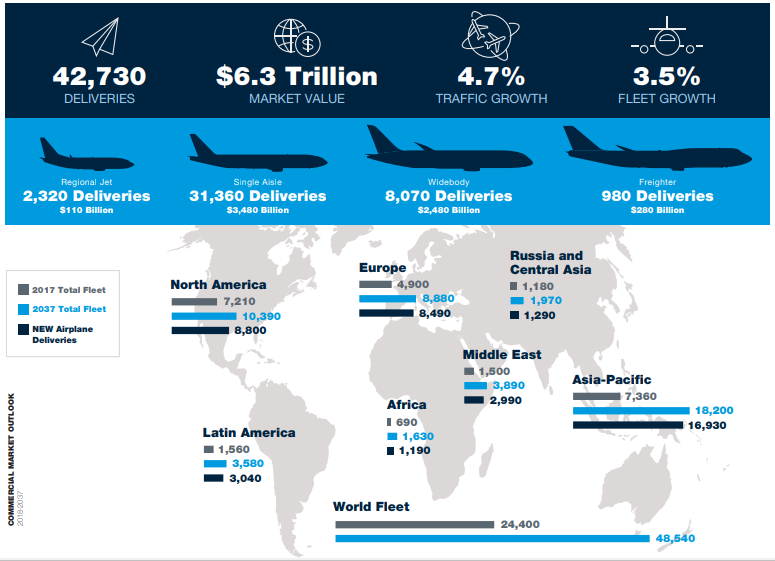

Boeing's forecast of 42,730 new jets over the next 20 years is valued at USD6.3 trillion and represents a +4.1% in total aircraft numbers over last year's report. Including aircraft that will be retained, the global fleet is therefore projected to essentially double in size to 48,540 by 2037. "For the first time in years, we are seeing economies growing in every region of the world. This synchronized growth is providing more stimulus for global air travel," says Randy Tinseth, vice president of Commercial Marketing for The Boeing Company.

Along with continued traffic expansion not only in the emerging markets of China and India, but also the mature markets of Europe and North America, Boeing says its data shows a big retirement wave approaching as older aircraft age out of the global fleet. It says that there are more than 900 aircraft today that are over 25 years old and by the mid-2020s, more than 500 a year will reach 25 years of age - double the current rate - fuelling the retirement wave.

CHART - Boeing has lifted its long-term forecast for commercial aircraft deliveries as rising passenger traffic and upcoming fleet retirements drive the need for 42,730 new jets - valued at USD6.3 trillion - over the next 20 years Source: Boeing Commercial Market Outlook 2018-2037

Source: Boeing Commercial Market Outlook 2018-2037

Expectedly, the single-aisle segment will see the most growth over the forecast period, with a demand for 31,360 new jets, an increase of +6.1% over last year, driven mainly by the continued growth of low cost carriers, strong demand in emerging markets, and increasing replacement demand in markets such as China and Southeast Asia. Boeing sees a need for 8,070 new aircraft in the widebody segment valued at nearly USD2.5 trillion and spearheaded, in part, by a large wave of replacements beginning early in the next decade and airlines deploying new generation jets such as its 787 Dreamliner and 777X to expand global networks.

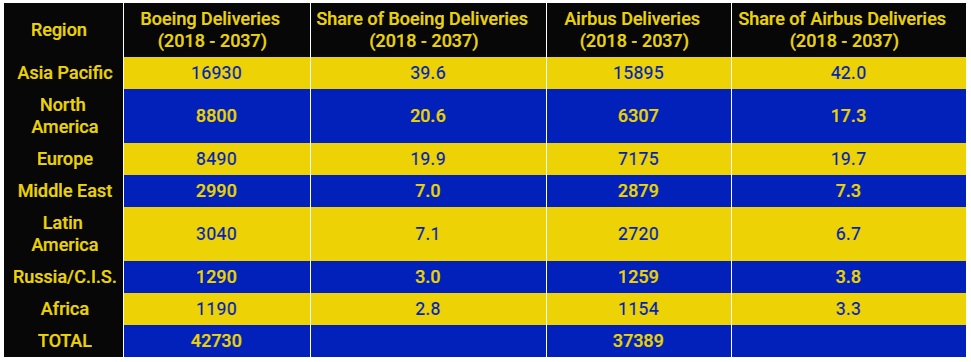

Airbus and Boeing both agree that Asia Pacific will dominate the future delivery schedule. Airbus, while predicting a slightly smaller demand has the region's share at 42.0% of deliveries over the next 20 years, while Boeing sees a smaller share at 39.6%. This viewpoint is due to Boeing predicting a slightly higher demand for aircraft in North America than its European counterpart (20.6% versus 17.3%).

TABLE - Airbus and Boeing may be slightly split on future demand numbers, but agree generally on where new aircraft will be delivered over the next 20 years Source: The Blue Swan Daily and Airbus and Boeing regional forecast data

Source: The Blue Swan Daily and Airbus and Boeing regional forecast data

The agreement between Airbus and Bombardier that has now seen the CSeries morph into the A220 and the new Boeing and Embraer partnership has blurred the lines between mainline and regional aircraft. Boeing's forecast shows an expected demand for 2,320 regional jet aircraft seating below 90 passengers over the next 20 years.

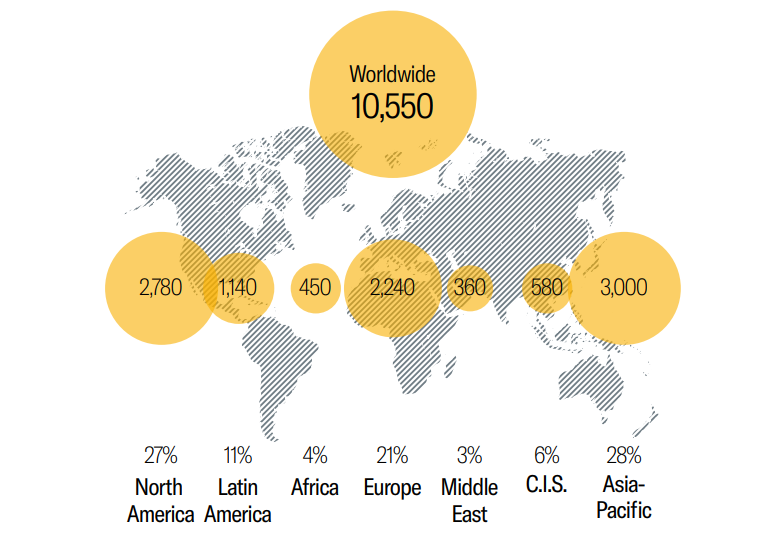

In the wider up to 150 seats market, Embraer says it forecasts demand for 10,550 new aircraft worldwide, worth USD600 billion, over the next 20 years. It says the in-service fleet is set to increase to 16,000 aircraft, up from the 9,000 aircraft currently in operation. Market growth will drive 65% of this demand, while the remaining 35% will replace ageing aircraft.

The manufacturer predicts the up to 150-seat segment will form "an ever more integral part" of the global air transport eco system and whilst its region-specific outlooks vary considerably, "efficiency and sustainability remain the underlying drivers of the projected market demand". It believes new generation aircraft such as its E2 family challenges the paradigm that smaller aircraft have higher CASK and instead now approach the seat cost economics of larger narrow-body aircraft with roughly 20% trip cost advantage.

Embraer says the economic performance of the airline industry will mostly depend on how far costs will rise and to what extent the industry can sustain a healthy revenue environment. "Past performance is no guarantee of future results," says John Slattery, president & CEO, Embraer Commercial Aviation. "We are now warming up for the next period of higher costs, with pressures on yields likely to continue unabated. Profits are eroding and gains wiped out with rising costs."

CHART - Embraer foresees world demand for 10,550 new aircraft with up to 150-seats over the next 20 years representing a total market value of USD600 billion Source: Embraer Market Outlook 2018-2037

Source: Embraer Market Outlook 2018-2037

Embraer expects world passenger traffic to maintain 4.5% annual growth over the next two decades, working on the conclusion that air travel has proven to be resilient to ruptures, always keeping its historical trend in the long term. By 2037, the Middle East and Asia-Pacific will be the fastest growing markets, with an annual RPK growth rate of +5.7%, it predicts, followed by Latin America with +5.2%, Africa with +4.8%, Europe with +3.7%, the Commonwealth of Independent States (CIS) with +3.6% and North America with +2.7%.

The 10,550 worldwide deliveries will be split to comprise 8,230 regional jets and 2,320 turboprops, according to Embraer and Asia-Pacific will dominate deliveries (28% share) ahead of North America (27%), Europe (21%), Latin America (11%), CIS (6%), Africa (4%) and the Middle East (3%).

Meanwhile, Japan's Mitsubishi Aircraft Corporation has a slightly different outlook and forecasts a demand for 5,000 regional jets over the next 20 years, projecting North America will account for 40% of the market. VP and general manager, head of commercial sales and marketing Yugo Fukuhara said the market is "at the beginning of the next upturn and we are in a very good position to capture the next upturn in orders". He noted the MRJ70 is the only new regional jet design that meets US pilot contract scope clauses, and that the MRJ90 could benefit from changes to scope clauses as reasons why it has such high aspirations for demand in North America.