There is much to consider in this short statement. Firstly, can klia2 be considered an LCCT? It was built as such and completed in 2014 at a cost of approximately USD1 billion at today's exchange rates, and is the largest such purpose-built facility in the region with an initial capacity of 45 million ppa. It exists because the original low-cost terminal (2006), which was fairly basic, was too far from the main terminal so that the 'self connection' principle that has become common since then was unworkable.

At the same time Singapore Changi airport's own 'budget terminal' (also developed in 2006) was identified for closure and the airport authority there opted for a different approach, dispersing LCCs into other terminals. In a way it appears now that Kuala Lumpur airport did the same, though not as openly.

Mr Fernandes has complained long, hard and frequently about klia2, the charges for using it and its Taj Mahal-like nature. It certainly doesn't look like a 'budget' facility, either outside or inside. klia2 is often described as an LCCT today simply because of AirAsia's overall dominance in the terminal as a budget airline.

Indeed it is more reminiscent internally of Changi airport, with a retail space of 35,000 square metres that accommodates 220 outlets. It is about as far as you can get from the original concept of a low-cost terminal. Those early examples - mainly in Europe apart from the original Singapore and Kuala Lumpur ones - were often 'hardship' terminals, constructed at absolutely minimum cost (under USD25 million was broadly the target) with no air bridges, concrete walls, hardly any seating and a 'carry your own bags' approach as far as possible.

The objective was to be able to charge the nascent LCCs as little as possible so they would increase their routes and frequencies, while ensuring that turnaround times were optimised as far as they could be. Hence there were hardly any shops or restaurants either.

Klia2 is perhaps indicative of how that original concept has changed over the years, in response to the hybridisation of the LCC and full-service models (though AirAsia has broadly stuck to the LCC principles and still has one of the lowest unit costs in the airline world).

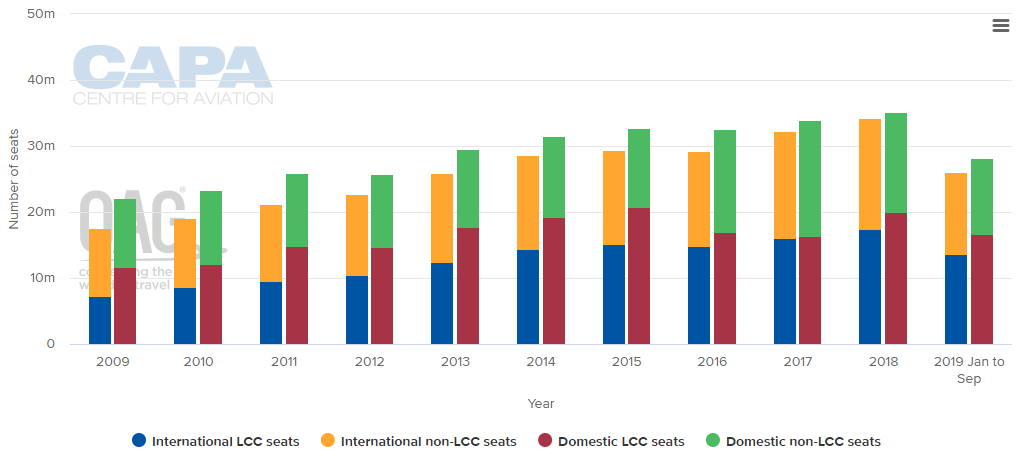

Mr Fernandes makes a reasonable point about the need for LCCTs at Penang and Kota Kinabulu as well as Kuala Lumpur. In the first nine months of 2019 LCC seat capacity in Malaysia amounted to 52.4% on international flights and 59.7% on domestic flights. That compares to figures of 33.2% 'within regions', and 13.6% 'to/from' regions, globally.

CHART - The Low Cost Carrier model is well established in Malaysia across both domestic and international markets Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

At Penang, low-cost seat capacity amounts currently to 62.8% of the total (44.8% being on AirAsia flights), while at Kota Kinabalu it is 68.3% (AirAsia 55.5%).

Mr Fernandes also cited the about-to-open Terminal 2 at Nagoya Chubu Centrair International airport in Japan as an example for Malaysian airports to follow. The 45,000 square metre, three-five million passenger per annum facility, costed at USD165 million, is scheduled to open on 20-Sep-2019.

With the terminal not yet open it is difficult to know why Mr Fernandes is so excited by it, except that what was a previously cancelled project following the termination of the AirAsia/All Nippon Airways joint venture was resurrected as a direct consequence of AirAsia's subsequent decision to re-launch AirAsia Japan. The 'concept' for this new terminal (T2) can be found here.

The key word is 'functionality'. A 'simple boarding system' and 'apron arrangement on the LCC business model' suggests low costs to users, as Japan continues to try to stimulate tourism by way of increasing LCC seats which are still low at a ratio of 26.9% international and 17.9% domestic.

If Mr Fernandes is so keen to have LCCTs in Malaysia, why doesn't he build and operate them himself? It wouldn't be groundbreaking. Jazeera Airways did just that in Kuwait, Bangkok Airways has three airports of its own, many terminals in the US are operated by airlines (though different circumstances apply there) and even in Europe the possibility is often raised by leaders of LCCs (but note that 'talk' is all they ever do). AirAsia itself has in the recent past talked about having its own terminals in Indonesia, then the Philippines, then throughout the ASEAN region and, latterly, of co-operating with Malaysia Airports Berhad to build budget terminals.

A lot of talk. What are we waiting for?