Air Canada's strategy in leveraging sixth freedom traffic is to target passengers in markets such as Boston, Pittsburgh or Nashville to make one stop through Canada en route to trans-Atlantic and trans-Pacific destinations. Air Canada has worked with its various hub airports to make the transit process easier - by eliminating the need to reclaim bags, and allowing customers to proceed directly to US customs.

Air Canada estimates its market share of international traffic to and from the US during 2016 was 0.9%. The airline believes growing its share to 2% could result in CAD1.2 billion of incremental annual revenue.

During 2017 Air Canada made a push from its Vancouver hub to Boston, Denver and Dallas. It faces no competitors on fights to Boston and operates alongside its Star Alliance partner United in Denver (a hub for United) and American on flights to its hub at Dallas/Fort Worth.

But Air Canada's relaunch of service from Memphis to Toronto in 2017 is a classic route to feed into one of its major hubs for long haul connections. Toronto is Memphis' only international destination available for the week of 22-Jan-2017.

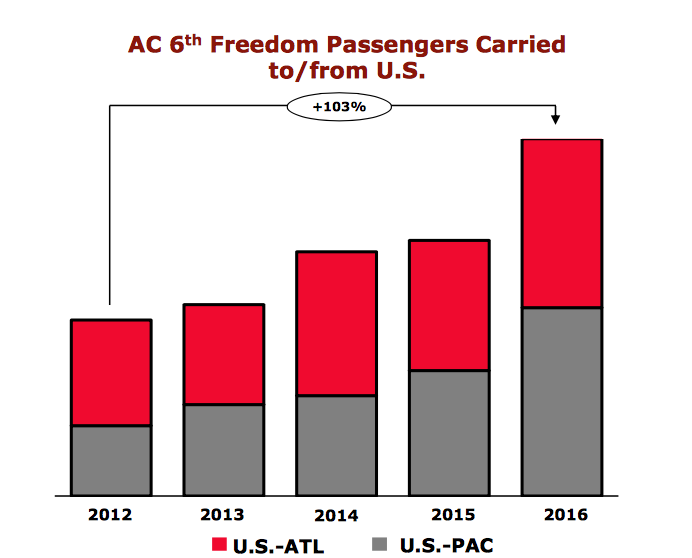

CHART - Air Canada has seen sixth freedom passengers to/from the United States of America double over the 2012-2016 period Source: Air Canada

Source: Air Canada

Air Canada's planned new US routes in 2018 fit its sixth freedom profile perfectly. It has no competitors on planned service between its hub in Montreal to Baltimore-Washington International airport and Pittsburgh International. It will be the lone airline on new service between Vancouver and Sacramento and Edmonton to San Francisco, a route previously served by its Star Alliance partner United.

As Air Canada pushes forward full steam ahead with its transborder sixth freedom strategy, its potential response to the proposed Delta-WestJet joint venture will be closely watched in 2018. The airline has hinted it could deepen ties with United after the two airlines abandoned plans to forge a joint venture in 2012 when Canada's competition bureau expressed concerns about market concentration on certain routes.

Nearly six years later, the transborder market has changed as WestJet continues its own transborder push, serving large hub markets including Chicago O'Hare, Denver, Dallas/Fort Worth, Los Angeles, San Francisco and Phoenix. Its proposed tie-up with Delta has the potential to create a certain level of upheaval in the Canada-US market.