The last year has delivered what the airline describes as "high levels of profitability and growth" with a record net profit of AED662 million (USD180 million), up almost a third (+30.2%) on the previous year. At group level the airline added 21 routes and took delivery of four new aircraft in 2017, ending the year with a network of 140 routes and a fleet of 50 A320 aircraft.

The airline's growth was driven by a network expansion strategy that was anchored by cost control across an operation impacted by political and economic challenges across the region. They were boosted by what the airline describes as a "solid" 4Q2017 where an improvement in yield margins and capacity rationalisation in the market helped the performance.

Speaking earlier this month at the CAPA - Centre for Aviation Global LCC Summit in Singapore, Adel Ali, CEO, Air Arabia Group confirmed that the carrier is in talks with manufacturers and intends to make a decision on an order for new aircraft in 2018. Mr Ali has suggested this order will be for around 100 aircraft with the Airbus A320neo, Boeing 737MAX and Bombardier C Series all under consideration.

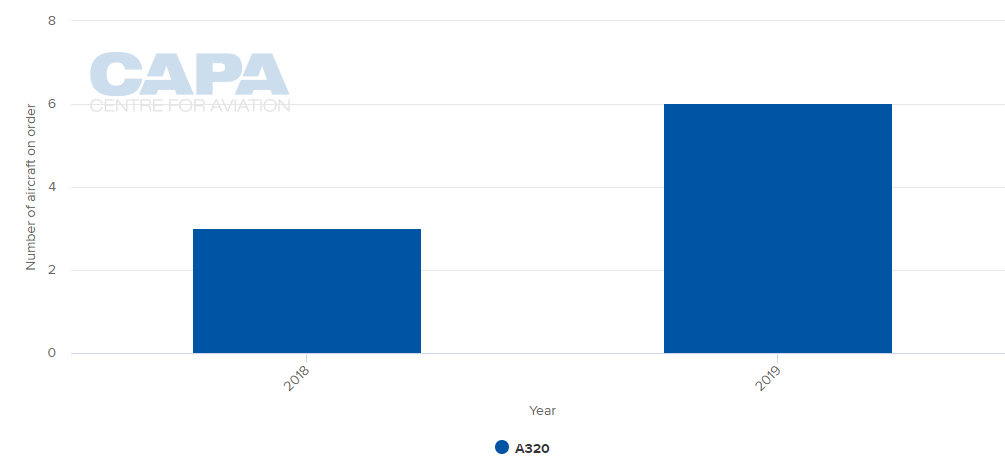

CHART - Air Arabia Group is already committed to receive three more A320s in 2018 and intends to add six leased A321neoLRs in 2019 Source: CAPA - Centre for Aviation Fleet Database

Source: CAPA - Centre for Aviation Fleet Database

The new aircraft order will be to both replace some existing eight to nine year old aircraft and to deliver growth, both in terms of frequencies and new markets. Air Arabia is known to be interested in adding to its network in India from its home base in Sharjah, United Arab Emirates (UAE), subject to changes in the currently bilateral, while other markets have been earmarked for growth, according to Mr Ali.

At the CAPA Global LCC Summit, he said Pakistan is potentially an important future market and India remains "a very big market" which will grow as the Indian economy improves, despite the carrier seeing a recent year-on-year yield dilution. He also expects Syria to be a potential market "if the conflict stops", while economic reform in Saudi Arabia will be positive in the long term and the country will be "a key market".

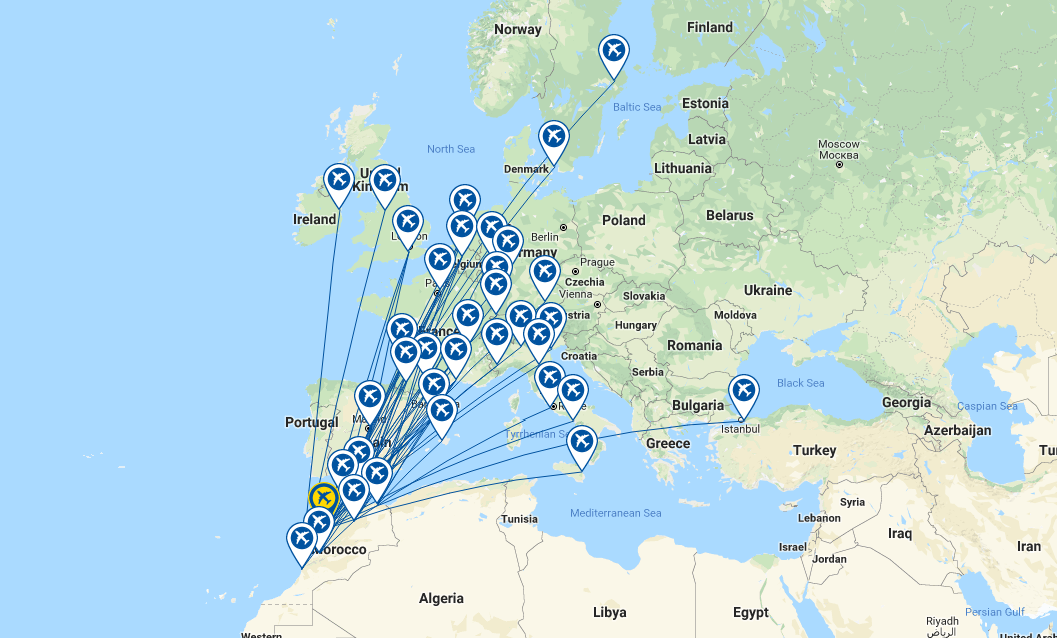

The carrier is also "extremely optimistic" with its operation in Egypt as tourists return to the country from Europe and regional markets. Mr Ali added that there is potential for Air Arabia Maroc to expand in Europe, particularly Eastern Europe, noting Russia has "good potential", while he also described West Africa as an "underserved" region with "high potential".

The Air Arabia fleet currently consists solely of A320 models which already operate some long flight sectors from Sharjah to Nairobi, Kenya and Urumqi, China. The flight envelope may be stretched further even before any new aircraft order as the six leased aircraft due to arrive in 2019 are all A321neoLRs from Air Lease Corporation and will permit Air Arabia to introduce new routes of six to seven hours boosting its range from Sharjah even further across Africa and Asia and even into western Europe, a market where its Air Arabia Maroc operation is seeing significant growth.

MAP - The Air Arabia Maroc network now extends across all of Europe with its year-over-year system capacity having grown more than a third (+37.5%) in 2017. It currently serves 30 international markets across 12 countries Source: CAPA - Centre for Aviation and OAG (data: w/c 12-Mar-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 12-Mar-2018)