Domestic traffic increased by 3% to 5.9m passengers, despite the increased activity of competitors, as connecting flows through Athens to the islands and lower fare offers have stimulated demand. The higher traffic levels were mainly the result of business efficiencies with average annual loads increasing from 77.4% to 83.2% despite the strong seasonality of demand in the Greek market.

From a financial perspective, revenues were up +11% to EUR1,127.6 million. The performance of the international routes boosted consolidated EBITDA at EUR120 million, 56% higher than the previous year. Pre-tax earnings reached EUR85.8 million, +66% higher than 2016, while net earnings after tax increased by +87% at EUR60.4 million.

It appears that Greece is on the road to recovery following its economic crisis. GDP is back in the black partly driven by tourism and exports having lost more than EUR67 billion or more than a quarter since the beginning of the crisis. Unemployment levels are falling and consumer confidence is also improving.

Tourism arrivals in Greece have grown more than 50% since 2003 from 17.9 million arrivals in 2013 to 27 million last year with international air travel contributing to this performance by growing at year-over-year rates of +17% in 2014, +5% in 2015, +8% in 2016 and +10% in 2017, but seasonality continues to impact capacity with Q3 demand accounting for around 45% of total annual traffic.

Aegean has been at the forefront of this growth, not just expanding its own activities, but delivering a schedule that now offers much better connectivity via Athens International Airport, an airport that unlike many across Europe still has considerable capacity to grow. In a ten year period the airline has transitioned from a point-to-point air service provider to a connected operation with transfer traffic growing five-fold since 2008 and now accounting for just under a third (32%) of its total Athens operation.

The Aegean network has grown from just 65 destinations in 2012 to 143 last year, achieved both from organic growth and the acquisition of Olympic Air and its domestic activities. Looking at Athens alone its network map has grown from 27 international destinations in 17 countries in 2013 to a planned 80 international destinations in 41 countries this year.

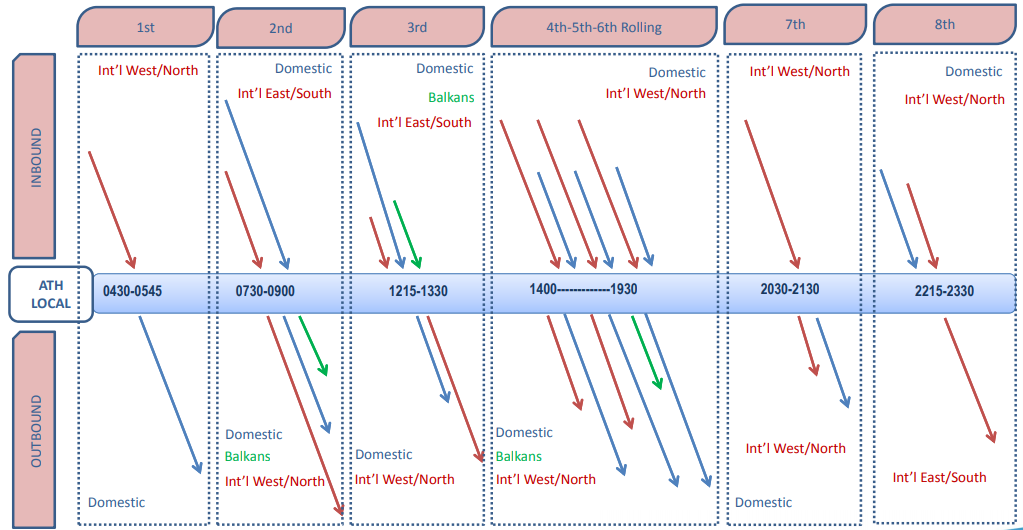

This has been supported by the airline identifying eight clear connecting waves through the day and feeding additional inbound and outbound markets into the banks through new routes and better scheduling. They are structured to support both local demand but also feed additional connecting flows into the system.

CHART - The Aegean Airlines wave structure identifies eight connecting banks through the day. The length of the lines denotes traffic volumes Source: Aegean Airlines

Source: Aegean Airlines

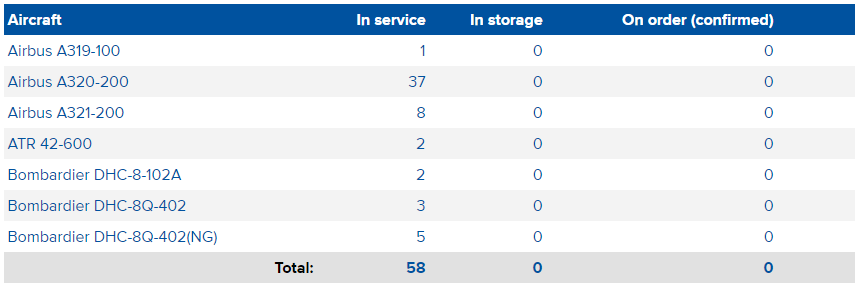

To further strengthen this operation, Aegean is adding new routes to Basel, Bologna, Cluj Napoca, Genoa, Lamezia, Malaga, Palermo, Porto, Turin, Verona, Zadar and Zagreb this year with eleven new destinations being served directly from Athens. This is being facilitated by better operational efficiencies but also the arrival of three additional aircraft, growing its fleet beyond 60 aircraft, up from just 45 aircraft a few years ago in the aftermath of the Olympic Air takeover.

TABLE - The Aegean Airlines Group fleet brings together the activities of Aegean Airlines and Olympic Air. A fleet renewal will see the arrival of new generation airliners and a consolidation of its turboprop flying around a single aircraft type Source: CAPA - Centre for Aviation Fleet Database

Source: CAPA - Centre for Aviation Fleet Database

The aim is to grow the fleet to 75 aircraft by 2023 when the network is forecasted to have expanded to 175 destinations, including around 130 directly from Athens. This will be supported by a fleet renewal between 2020 and 2025 and the arrival of new generation airliners such as the Airbus A320neo or Boeing 737MAX. The airline is understood to be close to reaching a final deal and an announcement is expected imminently.

Aegean says it is well positioned in this discussions as its existing lease expiration schedule allows for multiple options, the timing of its tender has come at a time that few major campaigns are in play and the manufacturers are eager to secure deals, while lessors also have ample orderbooks of these new generation airliners to place in the market.