This new weekly round-up will deliver some of the key aviation and travel news stories from across Africa.

- FEATURE: African airlines set to lose USD1.50 per passenger in 2018

- BRIEF: Ethiopian Airlines set to announce regional aircraft deal at Farnborough Air Show

- BRIEF: Aeroportos de Moçambique creates 2018-2022 strategic plan in bid to meet air traffic challenges

- BRIEF: Kenya targets 5m international tourist arrivals per year by 2030

- BRIEF: Air Burkina receives one CRJ900 and may add a second before the end of 2018

- BRIEF: Oman Air sees Muscat as future Asia-Africa hub

- ROUTE UPDATE: latest route launches and announcements

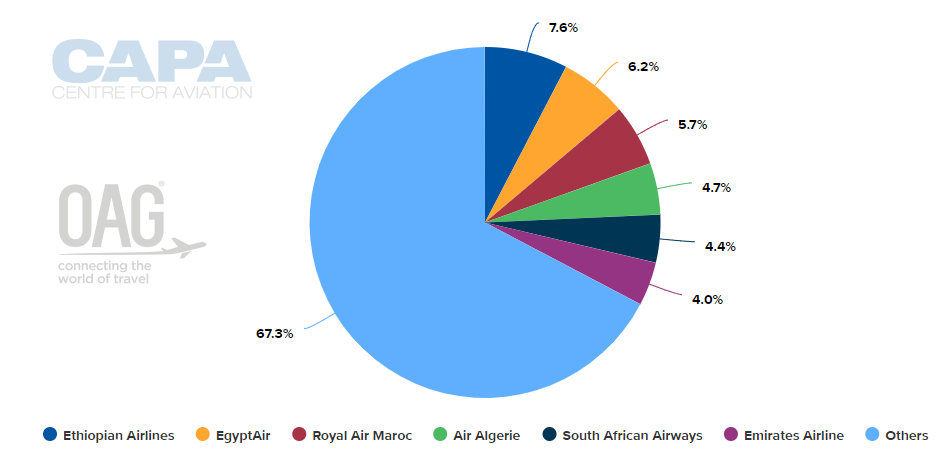

- DATA SNAPSHOT: Largest Airlines in Africa (w/c 25-Jun-2018)

African airlines set to lose USD1.50 per passenger in 2018

While there is strong optimism for change in Africa and the Continent offers the greatest aviation potential, it will, as a whole, remain the only loss making region of the world with African airlines set to lose USD1.50 per passenger in 2018, according to International Air Transport Association (IATA) estimates. The industry body highlights safety, connectivity, blocked funds, air traffic management and human capital as the five priorities which must be addressed for aviation to deliver maximum economic and social benefits in Africa.

Aviation currently supports 6.8 million jobs and contributes USD72.5 billion in GDP to Africa and over the next 20 years passenger demand is set to expand by an average of +5.7% annually. Aviation is uniquely placed to link Africa's economic opportunities internally and beyond, but so many obstacles remain on its path to success.

Speaking on behalf of IATA's director general Alexandre de Juniac at the 49th African Airline's Association Annual (AFRAA) General Assembly in Kigali, Rwanda, IATA vice president for Africa Raphael Kuuchi highlighted this: "Africa also faces great challenges and many airlines struggle to break-even. And, as a whole, the African aviation industry will lose USD1.50 for each passenger it carries."

"Governments should be aware that Africa is a high-cost place for aviation. Taxes, fuel and infrastructure charges are higher than the global average. Additionally, insufficient safety oversight, failure to follow global standards, and restrictive air service agreements all add to the burden that stands in the way of aviation's economic and social benefits," he added.

Here's a closer look at each of the five priorities:

Safety in Africa has improved, but there remains a gap to close to meet global standards such as the IATA Operational Safety Audit (IOSA), while only 22 African states have reached or surpassed the implementation of 60% of the International Civil Aviation Organization's (ICAO) standards and recommended practices (SARPs) for safety oversight.

Intra-Africa connectivity could finally be opened as nation's finally progress the African Union's Single Africa Air Transport Market initiative, a long time after the original Yamoussoukro Decision to liberate African skies was first signed. African economic growth is clearly being constrained by a lack of intra-Africa air connectivity and opportunities are being lost simply because convenient flight connections are not available.

Blocked funds remains an issue in Africa and airlines experience varying degrees of difficulty repatriating revenues earned in Africa from their operations in Angola, Algeria, Eritrea, Ethiopia, Libya, Mozambique, Nigeria, Sudan and Zimbabwe.

Air Traffic Management could be a big problem following decisions by Rwanda to leave the Dar-Es-Salaam Flight Information Region (FIR) and South Sudan to leave the Khartoum FIR and could deliver a future fragmented approach to flying around Africa.

Human capital could limit Africa's growth potential and need for a much expanded labour force. A skills shortage could be on the cards unless process are put in place to support the development of the future talent needed to deliver the benefits of aviation growth.

Ethiopian Airlines set to announce regional aircraft deal at Farnborough Air Show

Ethiopian Airlines Group CEO Tewolde GebreMariam has revealed the carrier will "hopefully" decide at the 2018 Farnborough air show on plans to potentially order Bombardier CSeries or Embraer E-Jets E2 aircraft in addition to more Boeing 787s, reports Reuters. The airline may order 10 to 20 CSeries or E-Jet E2 aircraft. The 2018 Farnborough International Airshow commences on 16-Jul-2018.

Aeroportos de Moçambique creates 2018-2022 strategic plan in bid to meet air traffic challenges

Aeroportos de Moçambique (AdM) chairman Emanuel Chaves stated (20-Jun-2018) Mozambique expects an increase in air traffic in the coming years, citing economic recovery, new entrants into the domestic market, hydrocarbon exploration activities, as well as political and social stability. The airport company recently developed a 2018-2022 strategic plan as it seeks to meet the anticipated challenges, with a particular focus on modernising Mozambique's airports.

Kenya targets 5m international tourist arrivals per year by 2030

Kenya's Government aims to increase international tourist arrivals from 1.4 million in 2017 to 2.3 million per annum by 2022 and to five million per annum by 2030. Plans include diversifying tourism offerings beyond safari and beach products. Under the Tourism Blueprint 2030 programme, the government aims to increase domestic and international tourist numbers to 30.4 million by 2030.

Air Burkina receives one CRJ900 and may add a second before the end of 2018

Air Burkina reportedly received one Bombardier CRJ900 aircraft (ZS-CMP) wet leased from CemAir in Ouagadougou in Jun-2018, according to reports. The aircraft is configured with six business class and 69 economy class seats. The airline will mainly operate the aircraft to regional destinations, including Abidjan, Accra, Bamako, Cotonou, Dakar, Lome and Niamey. The carrier is expected to introduce another CRJ900 in 4Q2018.

Oman Air sees Muscat as future Asia-Africa hub

Oman Air CEO Abdul Aziz Saud Al-Raisi said the airline aims to increase Muscat-Guangzhou frequency from four times weekly to daily and is also in talks with Chinese authorities to serve other cities in China, including Beijing and Shanghai. Mr Al-Raisi said: "We have also plans to increase flights to other Asian countries", and added: "We want Muscat to act as a hub for air-link between Asia and Africa. We are also looking to launch more flights to African countries". The carrier plans to commence Casablanca service on 01-Jul-2018 and intends to commence Rwanda and South Africa services.

Route Updates

- Malawian Airlines plans to commence daily Dar Es Salaam service on 15-Jul-2018. The airline will also introduce daily morning service from Blantyre to Lilongwe on 14-Jul-2018;

- Fastjet plans to increase domestic Zimbabwe Harare-Victoria Falls frequency from 11 to 13 times weekly, effective 02-Jul-2018. The airline also operates an international link from Victoria Falls to Johannesburg;

- Fly-SAX resumed Nairobi Wilson-Kitale service on 21-Jun-2018 after temporarily suspending the route following the crash of a Cessna Caravan aircraft on 05-Jun-2018;

- Air Algérie commenced twice weekly Algiers-Valencia service on 17-Jun-2018, according to Aena. The airline operates the service with 130 seat Boeing 737 equipment;

- Wizz Air plans to launch the following twice weekly services: Marrakech-Vilnius (from 29-Oct-2018) and Marrakech-Warsaw (from 31-Oct-2018). Marrakech is the second Moroccan city in the carrier's network;

- Air Ylang has reportedly received an air transport certificate from Comoros' National Civil Aviation and Meteorological Agency. The airline reportedly intends to serve regional destinations, including Anjouan, Dar Es Salaam, Madagascar, Mauritius, Mayotte, Moheli and Zanzibar.

DATA SNAPSHOT: Largest Airlines in Africa (w/c 25-Jun-2018) Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG