The Blue Swan Daily thought it would investigate. For European based carriers, we've looked at both the number of bookings and percentage of total bookings made in the United States highlighting those that are perhaps exposed to a higher degree of currency related cost and those that appear to be well blessed with US bookings.

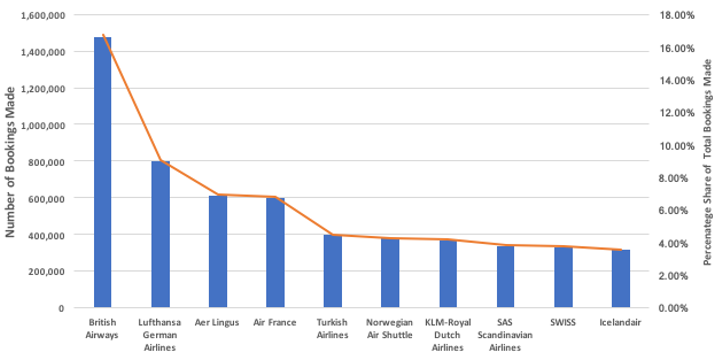

The chart below shows the top ten European airlines for bookings made in the United States. For many years British Airways has enjoyed a very strong transatlantic position reflected in their booking activity being nearly twice that of their closest competitor and accounting for some 16% of all bookings made with the airline.

CHART - The legacy airlines dominate when it comes to European airline bookings purchased in the United States of America based on data from the winter 2016/2017 schedule Source: The Blue Swan Daily and OAG Traffic Analyser

Source: The Blue Swan Daily and OAG Traffic Analyser

Interestingly Ryanair captured more bookings from the United States than Virgin Atlantic, whilst easyJet secured less than half the volumes recorded for the Irish-based carrier.

At the other end of spectrum, very nearly half of the airlines for which data was gathered reported less than 5,000 bookings over the five-month period. Included in this group were carriers such as bmi regional, SATA Air Acores, Meridiana and Braathens Regional Aviation.

With the USD trading at a 19% premium against the January 2015 Sterling exchange rate and an 11% premium against the Euro those airlines with little US$ revenue activity are increasingly exposed to the potential of a harsh winter.

Reflecting on the analysis, John Grant from MIDAS Aviation noted that this reinforces the very real benefits the major legacy and hub carriers enjoy from geographically diverse networks.

"Another important factor that needs to be recognised is the value that alliances and codeshare partners bring to airlines networks; creating cost effective distribution channels in overseas markets can be challenging and there is no doubt that such partnerships can really help carriers, especially at the margin," he adds.

Over time exchange rates fluctuate and the US Dollar may weaken over the next twelve months, but with the ongoing uncertainty over the Brexit process it would be a brave person to call any significant change from today's rates. With one recent airline collapse citing the strength of the US Dollar as a key issue and a potential winter of excess capacity and perhaps softening yields, it may just be that those with limited US Dollar income will be running for cover in early 2018.