Summary:

- Tickets booked fewer than seven days prior to departure are, on average, 44% more expensive than the same ticket booked 15 days in advance.

- In the USA, cost premiums on domestic travel booked fewer than eight days in advance of travel are 39% higher than the same ticket booked 15 days in advance.

- Concur analysis uncovers notable differences in booking patterns across countries such as USA, France and Canada although all three experienced rise in early bookings for December.

- Analysis discovers variation in increases by fare class - economy and premium economy ticket prices increase more than premium ticket prices in the eight- to 14-day window prior to a trip.

Building on these findings, the travel and expense management specialists have now analysed historical domestic business travel data to explore patterns in last-minute travel across the globe, in specific industries and among different age groups looking specifically at the zero to three days, four to seven days, eight to 14 days, and more than 15 days out booking windows.

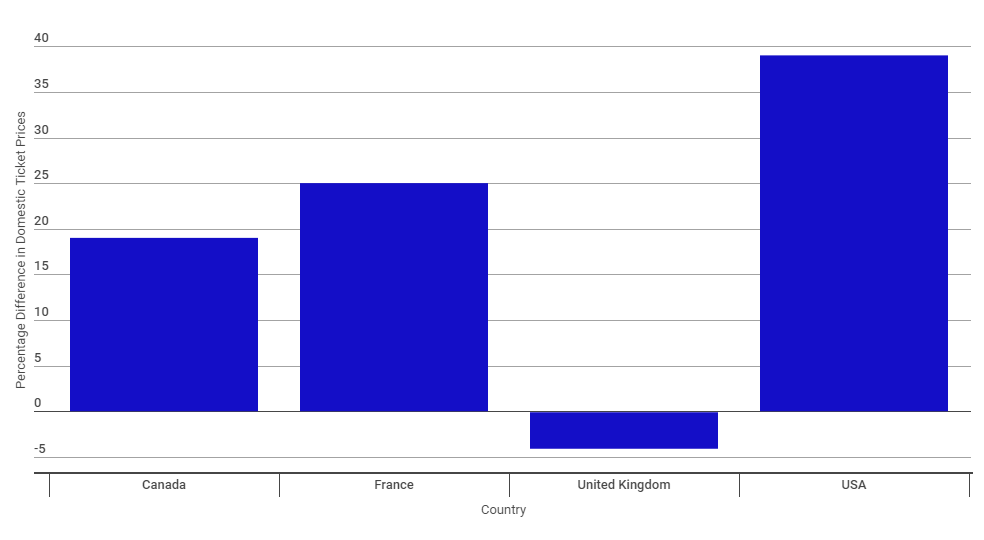

These new findings generally support last year's assumptions that ticket prices increase as the travel dates approach, but show significant variance in price increases on last-minute travel from country to country. In the USA, cost premiums on domestic travel booked fewer than eight days in advance of travel in 2016 are highest - up 39% on the same ticket booked 15 days in advance. High premiums were also noted in France (+25), Canada (19%) and Germany (16%), albeit the UK actually broke the trend with a (-4%) premium, i.e. fares were actually cheaper the closer to departure date. This is explained by Concur as being due to price change dynamics for domestic travel being "unique when compared to other countries with larger domestic travel markets".

CHART - Cost premiums on domestic tickets booked efwer than eight days in advance of travel versus he same ticket booked 15 days in advance differ significantly from country to country Source: The Blue Swan Daily and Concur

Source: The Blue Swan Daily and Concur

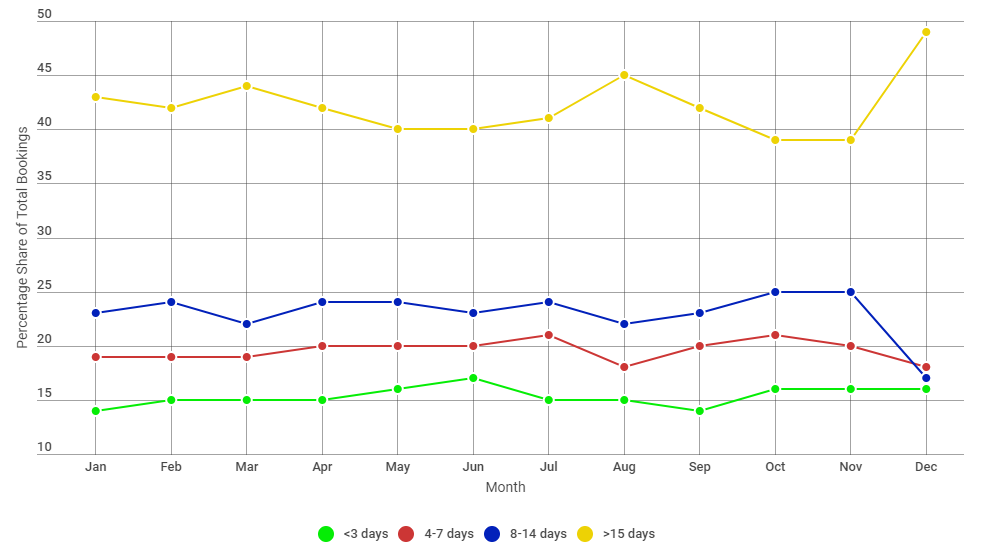

The Concur analysis also uncovered notable differences in booking patterns across countries such as USA, France and Canada although all three countries experienced an uptick in early bookings for December, when travellers are likely planning around holiday schedules. In addition, France experiences a dramatic spike in advance bookings for August, likely due to trips booked around upcoming holidays.

By comparison, its analysis in 2016 found that premiums on last-minute travel in the US are highest in January and August. The best month for last-minute travel in the US, according to Concur is June, when premiums average about eight percentage points lower in comparison to the overall flight costs. But low premiums on last-minute travel still come with a price: general ticket prices in June are 9% more expensive on average, according to its findings.

CHART - More than 40% of domestic air tickets in the USA were booked more than 15 days in advance in 2016, growing to almost 50% in December Source: The Blue Swan Daily and Concur

Source: The Blue Swan Daily and Concur

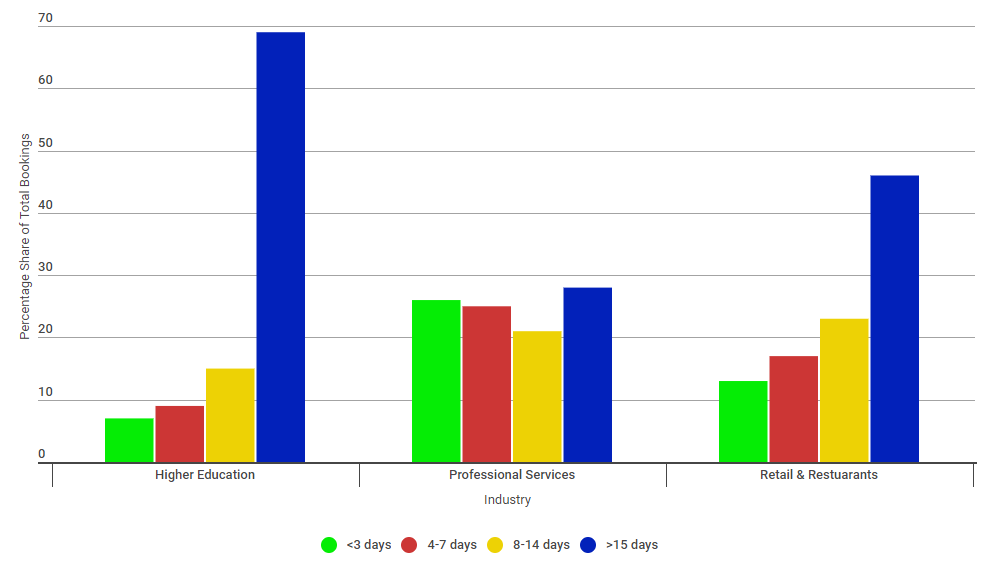

The latest insights also identified that travellers in the higher education industry are the best when it comes to early planning. In fact, Concur says data shows they are twice as likely to book trips at least 15 days in advance and only 31% of higher education travellers book fewer than 15 days in advance. Professional services, retail and restaurants represent a comparatively higher percentage of last-minute travellers. Understandably, the volume of last-minute travel is higher in business services, which can be attributed to client meetings and activities that are more difficult to anticipate in advance.

CHART - Travellers in the higher education industry are the best when it comes to early planning, according to this latest insight Source: The Blue Swan Daily and Concur

Source: The Blue Swan Daily and Concur

Other insights from the updated analysis include a variation in increases by fare class with economy and premium economy ticket prices increase more than premium ticket prices in the eight- to 14-day window prior to a trip. However, all fare classes continue to increase in cost in the seven days leading up to a trip, the rate of increase in premium economy tickets slows.

Additionally, although strikingly similar, the data also identifies subtle differences in traveller behaviour across different age groups. For example, baby boomers (age 49-65) book just 3% more of their tickets more than 15 days in advance than millennial (age 22-35) workers. This point, says Concur, becomes more interesting when compared to the fact that baby boomers book 4% less travel in the final week leading up to a trip.

Concur's recent report on generational trends in corporate travel and expense found that millennials are more budget-conscious with some expenses than their colleagues. Millennials spend 18% less than GenX (age 35-49) and baby boomer employees on dining and entertainment (approximately USD44 per transaction compared to USD52) and USD33 per meal when traveling compared to GenX and baby boomer employees that average USD39.

Armed with these additional insights, Concur advises corporate travel managers to:

- Implement travel policies that encourage employees to book at least eight days prior to departure, saving USD148 per ticket on average;

- Offer recurring trainings to educate employees and empower them to make smart, cost-friendly travel decisions and make them aware of alternative airport options and incremental add-on fees etc;

- Avoid a one-size-fits-all approach - last-minute travel trends vary from market to market and industry to industry and should be customised by region or between departments.